First-Time Homebuyer Quits Government Scheme After Persistent Setbacks

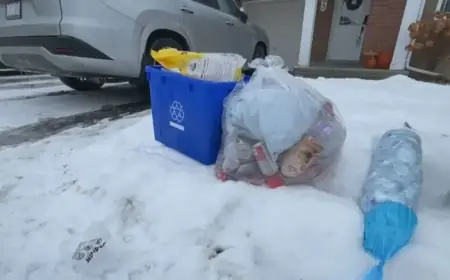

The journey of first-time homebuyer Erin Bell serves as a cautionary tale about the challenges faced by many prospective buyers trying to navigate government housing schemes. Her experience offers vital insights into the MyHome scheme, which is designed to assist those struggling to afford housing in Tasmania.

Erin Bell’s Struggles with the MyHome Scheme

The MyHome scheme aims to make homes accessible to first-time buyers by allowing the Tasmanian government to own a portion of the property. Under this program, the government contributes up to 30% of the cost for existing homes and 40% for new ones. Applicants must repay this share at the property’s market value over a 30-year period.

At age 32, Erin Bell faced a series of setbacks during her six-month quest for home ownership. After applying three times between March and August, she encountered a significant roadblock due to her personal relationship. Her initial application was declined because she was not classified as ‘single’, despite being in a relatively new relationship.

Eligibility Challenges

- Erin was initially required to list her boyfriend on the application, which she opposed.

- After contacting Homes Tasmania, her status was reinstated to ‘single’.

- The income test for the MyHome scheme further complicated her situation, as some buyers are exempt from this requirement.

Bank of us, the scheme’s lender, had approved Bell for a $440,000 home, but her search revealed a scarcity of properties in Hobart within that price bracket. Data indicated that by September, only 67 homes priced under $440,000 had sold, comprising just 4.4% of total sales.

Heavy Price and Delays

Processing time proved to be another challenge. The scheme typically requires around 90 days for application processing, which can deter sellers. Bell reported an experience where a vendor refused her offer due to perceived risks associated with waiting for approval from both the government and the lender.

Eventually, Bell pivoted to building a new home, securing a quote for a house and land package from Creative Homes Hobart for $506,000. Unfortunately, a subsequent valuation deemed the property worth $31,000 less than expected, based on a report from an independent valuer commissioned by Bank of us.

The Drawbacks of MyHome

Frustrated with the ongoing setbacks, Bell ultimately decided to abandon her pursuit of homeownership through the MyHome scheme. She criticized the program, expressing disbelief in its effectiveness. With six months of effort behind her and no success, she concluded the initiative didn’t meet her needs.

Creative Homes Hobart’s director confirmed that while the scheme attracted numerous inquiries, the majority of these did not result in contracts. Concerns from builders regarding lengthy approval processes and property valuations indicate systemic issues within the MyHome program.

Expert Opinions on MyHome

Homes Tasmania, responsible for administering the MyHome scheme, defends its effectiveness, noting it has helped many achieve their homeownership dreams. However, they acknowledge the need for improvements to streamline processes and support for applicants.

The Housing Industry Association (HIA) reports that the program has significantly impacted housing affordability. However, they also emphasize that these barriers must be addressed to maintain its success.

Conclusion

Erin Bell’s experience highlights the complications associated with government housing assistance programs, particularly for first-time homebuyers. The MyHome scheme, while beneficial for some, clearly requires reevaluation to better serve individuals like Bell, who seek a more streamlined approach to achieving their dream of homeownership.

As the landscape of housing continues to evolve in Australia, improvements in programs like MyHome will be essential in addressing the challenges faced by prospective homeowners.