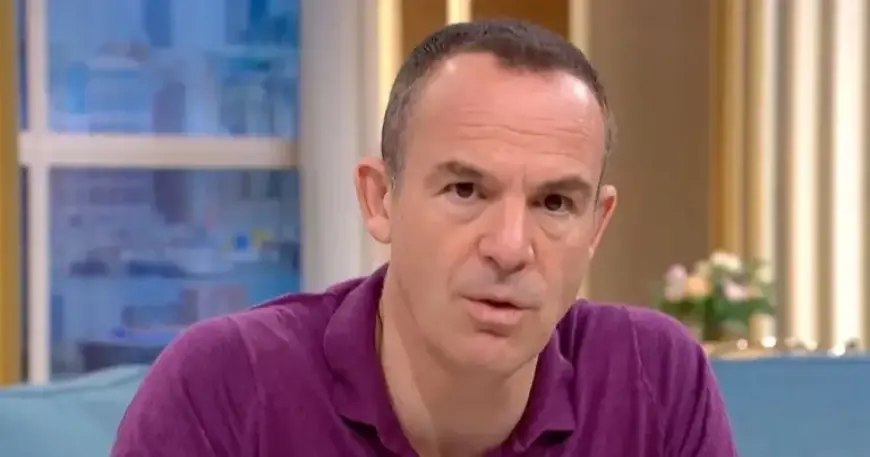

Martin Lewis Alerts Savers with Over £20,000 on Savings Risks

Financial expert Martin Lewis has recently alerted savers with accounts exceeding £20,000 about potential tax liabilities on their interest earnings. His warning comes as households may face increased taxation due to the government’s decision to freeze tax bands, announced by Chancellor Rachel Reeves.

Understanding Tax Risks on Savings

According to Lewis, this policy change may affect a growing number of savers. Households experiencing income growth could find themselves in higher tax brackets, resulting in a tax on the interest they earn from their savings.

Tax Allowances for Savers

Most employees earning less than £50,000 benefit from a personal savings allowance. This allows them to earn up to £1,000 in interest annually without incurring tax liabilities. Lewis mentioned:

- Basic Rate Taxpayers: For those earning between £12,500 and £50,000, the allowance is £1,000.

- Higher Rate Taxpayers: Individuals earning between £50,000 and £125,000 have a reduced allowance of £500.

With easy access savings accounts currently offering interest rates around 5%, a savings balance of about £20,000 is necessary to earn £1,000 in interest. Lewis emphasized that those with savings at this level or lower who qualify as basic rate taxpayers are unlikely to face tax on their interest income.

Strategies for Minimizing Tax on Savings

To manage their finances effectively, savers are encouraged to explore government-sanctioned schemes designed to maximize savings while minimizing tax liabilities. As the new year begins, understanding these strategies becomes crucial for individuals aiming to grow their wealth efficiently.

In summary, savers should assess their financial situations and make informed decisions to navigate potential tax implications effectively.