JPMorgan CEO Warns Trump’s 10% Credit Card Cap Could Trigger Economic Disaster

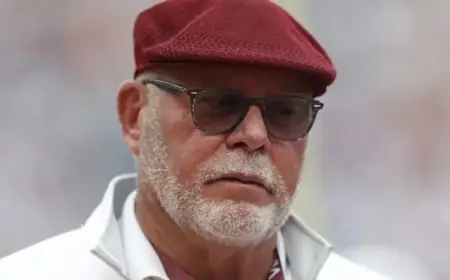

JPMorgan Chase’s CEO, Jamie Dimon, warned of potential economic repercussions due to President Trump’s proposed 10% credit card cap. During an interview at the World Economic Forum in Davos, Switzerland, Dimon expressed concerns that this cap could lead to significant cutbacks in credit availability for millions of Americans. He labeled the proposal an “economic disaster” that might drastically impact the credit card industry.

Concerns Over the Credit Card Cap

Dimon highlighted the risks, stating that up to 80% of Americans could find their credit limits reduced. He acknowledged the political aspect of the cap, which garners support mainly from Democratic legislators. Dimon cautioned that enforcing such a cap in select states, like Vermont and Massachusetts, would reveal its adverse effects.

Trump’s Proposal Details

Earlier in January, President Trump proposed a one-year cap on credit card interest rates, effective from January 20. He claimed this move is designed to protect consumers who are burdened by high-interest rates ranging from 20% to 30%. Alongside this policy, Trump initiated a $200 billion mortgage bond-buying strategy and issued an executive order to limit institutional investors in the single-family housing market, all aimed at enhancing affordability.

Industry Responses and Implications

- Many banking executives, including those from Bank of America, Citigroup, and Wells Fargo, expressed alarm at the implications of a 10% cap.

- Industry leaders warned that such government constraints could restrict credit approvals to those with top-tier credit scores while dismantling beneficial rewards programs financed by interest income.

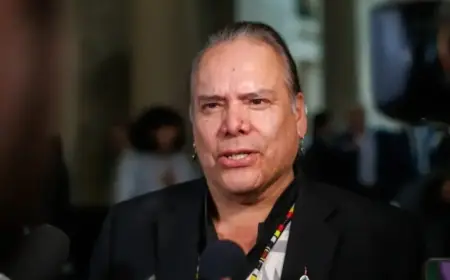

- JPMorgan’s CFO Jeremy Barnum echoed Dimon’s concerns, suggesting that the cap would be detrimental to consumers and the broader economy.

Emerging Alternatives

Despite the concerns raised by major banks, some companies are starting to embrace Trump’s plan. For instance, Bilt, a New York-based startup, recently introduced credit cards with a 10% APR for the coming year, positioning itself as a pioneer in response to the proposed cap.

As discussions continue, JPMorgan is preparing a detailed analysis of the potential impacts to share with government authorities. Dimon’s comments illustrate the significant tension between regulatory efforts to protect consumers and the potential limitations banks face in responding to such mandates.