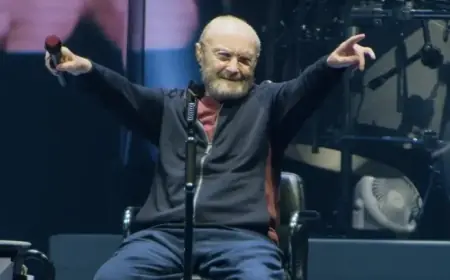

Ubisoft Games Enter a New Era: Major “Reset” Cancels Prince of Persia Remake, Delays Seven Titles, and Splits Teams Into Five Creative Houses

Ubisoft’s games slate is getting a dramatic shake-up after the company announced a sweeping organizational and portfolio “reset” designed to reclaim creative momentum and restore sustainable growth. The plan, unveiled January 21, 2026, restructures Ubisoft around five specialized “Creative Houses,” cancels six projects—including the long-troubled Prince of Persia: The Sands of Time remake—and pushes seven other games back for additional development time.

For players, the headline is mixed: fewer near-term releases from Ubisoft’s pipeline, but a clear attempt to prioritize quality, reduce internal friction, and refocus on the company’s biggest strengths—open-world adventures and live-service-native experiences.

What’s Changing for Ubisoft Games in 2026

Ubisoft is moving to a more decentralized model where each Creative House combines development and go-to-market functions and carries clearer financial accountability. The idea is to speed up decisions, specialize teams around specific kinds of player experiences, and keep a tighter loop with communities earlier in development.

The new structure is scheduled to begin operating in early April 2026. Alongside the reorg, Ubisoft says it plans to return teams to five days per week on-site, with a set annual allowance for working-from-home days—framed as a collaboration and efficiency push in a more selective, higher-cost AAA market.

Six Cancellations, Seven Delays: The Biggest Portfolio Shock

The most attention-grabbing cancellation is Prince of Persia: The Sands of Time remake, a project that has been rebooted and delayed repeatedly over the years. Ubisoft also discontinued four unannounced titles—three of them described as new IPs—plus a mobile title.

Separately, Ubisoft is allocating additional development time to seven games. One of those is an unannounced title that was initially planned for its FY26 window but has now slipped into FY27. Ubisoft’s messaging is consistent: it would rather take the short-term hit than ship games that don’t meet higher “quality and selectivity” standards.

For fans tracking Ubisoft games by franchise, this also signals a more conservative greenlight process for brand-new series, at least until the company stabilizes costs and rebuilds confidence in its release cadence.

The Five Creative Houses: Where Major Ubisoft Franchises Now Live

Ubisoft’s new operating model groups its brands by experience type. Here’s how the company is mapping the universe:

| Creative House | Focus | Examples of brands mentioned |

|---|---|---|

| CH1 (Vantage Studios) | Scale the largest franchises into “annual billionaire brands” | Assassin’s Creed, Far Cry, Rainbow Six |

| CH2 | Competitive and cooperative shooter experiences | The Division, Ghost Recon, Splinter Cell |

| CH3 | Select “Live” experiences | For Honor, The Crew, Riders Republic, Brawlhalla, Skull & Bones |

| CH4 | Immersive fantasy worlds and narrative-driven universes | Beyond Good & Evil, Might & Magic, Prince of Persia, Rayman |

| CH5 | Casual and family-friendly games | Hasbro portfolio, Hungry Shark, Just Dance, UNO |

A notable detail: Vantage Studios is tied to a major investment partnership with Tencent, signaling that Ubisoft’s largest tentpoles—especially Assassin’s Creed—sit at the center of the turnaround plan.

Cost Cuts and Studio Changes: The Other Half of the Reset

The reset is not only about design philosophy. It’s also about cost structure.

Ubisoft is accelerating cost reduction efforts and continuing restructurings across the group. Actions already identified include closures of the Halifax mobile studio and the Stockholm studio, plus restructurings tied to teams in Abu Dhabi, RedLynx, and Massive. The company is also keeping the door open to potential asset divestitures, a phrase that often points to selling non-core pieces to fund the rebuild.

In plain terms: Ubisoft wants fewer projects in flight, more time on the ones that remain, and a leaner organization that can ship reliably without ballooning budgets.

What This Means for Ubisoft’s Game Roadmap and Release Expectations

Ubisoft is placing its bets on two pillars: open-world adventures and game-as-a-service-native experiences, supported by “cutting-edge technology” and stated investments in player-facing generative AI. That doesn’t automatically mean every game becomes a live service, but it does suggest the portfolio will skew toward long-tail engagement models where sustained player activity and in-game spending can matter as much as launch-week sales.

At the same time, the cancellations and delays are a reminder that Ubisoft’s near-term calendar may be thinner than fans expected. That typically increases pressure on the company’s biggest franchises to deliver both quality and commercial impact—because fewer releases means fewer chances to offset a miss.

Players Still Get Updates: Live Games and Back Catalog Support Continue

Even amid the reset, Ubisoft’s ongoing support machine is still active. Recent updates have rolled out for key live titles (including major patch work in Rainbow Six Siege), and Ubisoft has continued to refresh older catalog games with performance improvements—moves that help keep players engaged while the future pipeline is being rebuilt.

That dual-track approach—maintain live ecosystems today while reshaping the next wave—will likely define Ubisoft games through 2026: fewer “surprise” new projects, heavier emphasis on established communities, and a louder internal push to ensure the next launches arrive with fewer compromises.

The Financial Reality Behind the Reset

Ubisoft’s revised outlook underscores how disruptive this moment is. For FY2025–26, the company now expects net bookings around €1.5 billion and a non-IFRS operating result around a €1 billion loss, alongside negative free cash flow in the range of roughly €400–€500 million. Ubisoft also said it will update longer-range guidance in May 2026.

For gamers, those numbers translate to a simple takeaway: this reset is not cosmetic. Ubisoft is accepting real short-term pain to try to rebuild its pipeline, improve consistency, and protect the long-term value of its biggest series.

If you want, tell me which Ubisoft franchise you care about most (Assassin’s Creed, Far Cry, Rainbow Six, The Division, Prince of Persia, etc.) and I’ll break down what this reset likely means for that specific series’ release timing and direction.