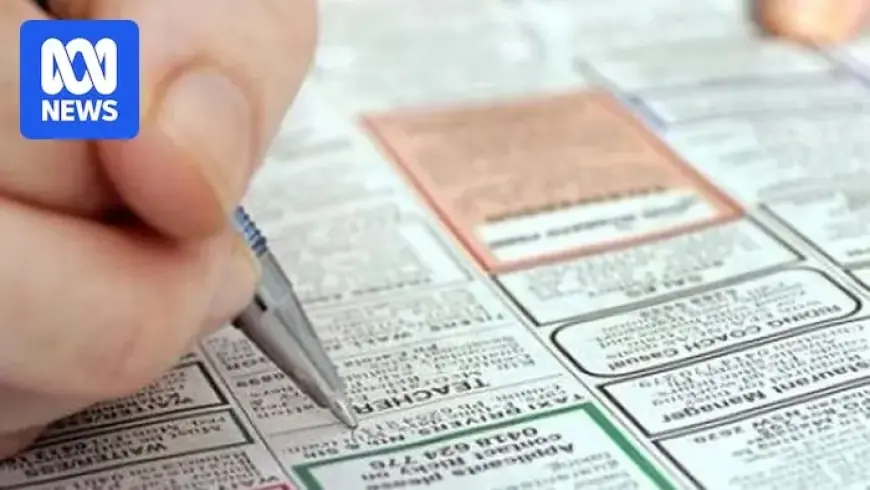

Job Data Surprises, Boosting Rate Hike Expectations

Australia’s job market presents surprising data that may influence future interest rate decisions. In December, the unemployment rate dropped from 4.3% to 4.1%. This decline is noted in seasonally adjusted figures released by the Australian Bureau of Statistics (ABS). The Reserve Bank of Australia’s upcoming interest rate meeting takes place on February 3, and recent jobs data, along with other economic indicators, will play a crucial role in their deliberations.

Influence of Job Market Data on Interest Rates

While many economists anticipated no change in interest rates, the stronger-than-expected employment figures may prompt reconsideration. KPMG’s chief economist, Brendan Rynne, remarked that the latest job statistics exceeded general expectations significantly. He emphasized that the data indicates a robust labor market.

- Employed individuals increased by 65,000 in December.

- Full-time employment grew by 55,000, while part-time jobs added 10,000.

- The participation rate rose to 66.7%.

Surge in Young Workforce

A notable factor contributing to this decline in unemployment is the rise of younger individuals entering the job market. Sean Crick, head of labor statistics at the ABS, explained that employment among 15 to 24-year-olds positively impacted overall employment figures.

Gender Disparities in Employment Growth

The increase in employment was primarily driven by male workers, whose numbers rose by 49,000. Female employment saw a smaller gain, with an increase of 17,000.

Economic Predictions Amid Rate Hike Discussions

Harry Murphy Cruise from Oxford Economics Australia noted his initial expectations of rising unemployment. However, he now sees the labor market remaining resilient. He commented that if inflation persists, a rate hike might be necessary to control it. Market predictions shifted significantly following the job report, with the likelihood of an interest rate increase at the next meeting rising to 53.8%.

Expert Opinions on Future Rate Movements

Despite the upbeat job report, some experts express caution. Stephen Smith from Deloitte Access Economics cautioned that the economy might not be strong enough for a rate increase. He characterized the decision in February as “lineball,” suggesting that the Reserve Bank should remain vigilant given recent fluctuations in inflation data.

| Economic Indicator | Value |

|---|---|

| Unemployment Rate (December) | 4.1% |

| Employment Growth (December) | 65,000 jobs |

| Participation Rate | 66.7% |

| Likelihood of Rate Hike next meeting | 53.8% |

Job Ads Trends and Economic Outlook

Regarding job advertisements, Seek’s recent data indicate a 3.5% decline in national job ads for 2025. December showed a decrease of 1.2%, slightly more than the typical seasonal drop. Experts will soon determine if January can rejuvenate the employment market as businesses resume operations after the holiday period.

In conclusion, Australia’s latest job data presents a complex scenario for the economy and interest rates. As discussions evolve toward the Reserve Bank’s next meeting, market analysts now have to consider both surprising job growth and underlying economic weaknesses.