Buyers Sought for Sanjeev Gupta’s Tahmoor Coal Mine

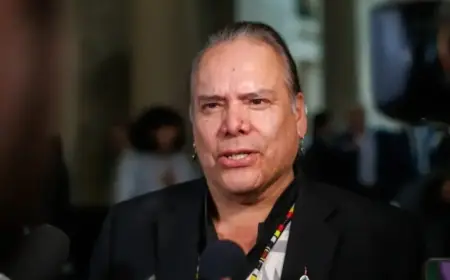

Buyers are being sought for the Tahmoor Coal Mine as the GFG Alliance, led by Sanjeev Gupta, faces significant financial challenges. The administrators aim to restart the mine and maximize returns for creditors following a lengthy period of non-operation.

Tahmoor Coal Mine Overview

Located southwest of Sydney, the Tahmoor coking coal mine has not been operational since February of the previous year. This halt was due to depleted cash reserves amid ongoing financial turmoil at GFG Alliance. As a result, approximately 500 workers, including contractors, were placed on minimum pay. By November, around half of these workers were notified that their wages would be terminated.

Administration and Expressions of Interest

Liberty Primary Metals Australia (LPMA), the mine’s holding company, entered administration in November. Joint administrator Michael Brereton from William Buck emphasized that selling Tahmoor is pivotal for unlocking value for creditors. “Now that the Deed of Company Agreement has been approved, we need to realize assets within the group,” he stated.

The expression of interest process for potential buyers opened recently and will last until February 11. Brereton noted that there has already been strong interest from industry players, even prior to the initiation of formal processes. He mentioned receiving six expressions of interest before Christmas, with more inquiries following.

Funding and Restarting the Mine

The Tahmoor Coal Mine has an estimated value of hundreds of millions of dollars. The current goal is not only to maximize this value but also to restart operations quickly. Brereton expressed hope that established coal industry players could step in and take over, given their financial capacity and market understanding.

Assessment of Bids

All bids will be carefully evaluated based on various factors including value, restart costs, and financial capability. Short-listed bidders can expect a due diligence process lasting four to six weeks. The administrators aim to finalize a transaction by March or early April.

Community Impact and Future Options

Brereton acknowledged the community’s concerns, stating that the administration team was committed to securing the mine’s funding and ensuring a swift restart. LPMA’s CEO Theuns Victor highlighted Tahmoor as an established underground longwall mine with significant infrastructure and a skilled workforce.

Victor noted the desire to restart Tahmoor Colliery and mentioned that all reasonable options would be considered, including a sale of the company, joint ventures, or other financing solutions.