Global Markets Jolt Amid Greenland Tensions

The global financial landscape faced a jolt following escalated tensions surrounding Greenland. President Trump’s recent threats to impose tariffs on European nations significantly impacted U.S. assets, cascading into overseas markets.

Market Reactions to Greenland Tensions

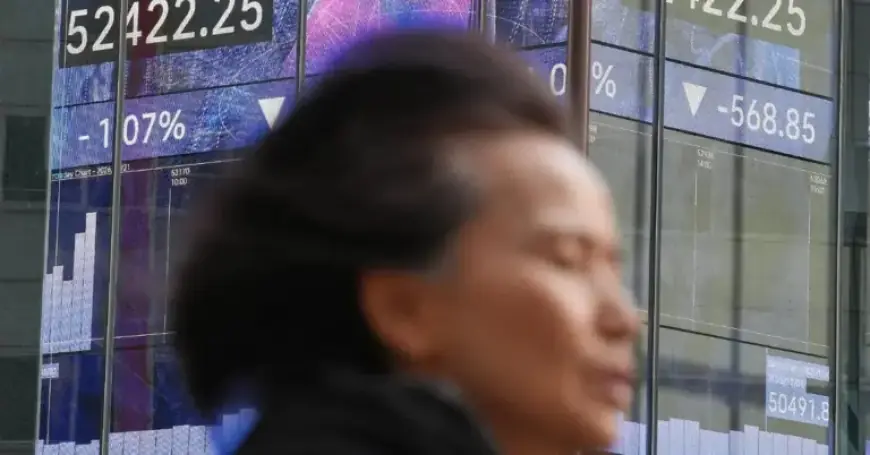

U.S. stock futures indicated a slight uptick, despite a marked sell-off in domestic markets. The widespread fallout from Trump’s tariff threats led to notable declines in Asia. Investors reacted swiftly, resulting in:

- Taiwan’s Taiex index dropped over 1.5%.

- Japan’s Topix index fell by 1%.

European markets displayed mixed results, with minor losses in France and Germany, while the UK market remained stable.

Impact on Currency and Precious Metals

The dollar showed mixed performance, weakening against the Japanese yen, but strengthening against the euro. In contrast, gold prices surged, reaching new heights above $4,800 per ounce, driven by safe-haven demand in times of uncertainty.

Gold Market Insights

A recent survey from the London Bullion Market Association (LBMA) indicated strong expectations among metals analysts. Many predict that gold prices could surpass $5,000 per ounce within the year.

- Geopolitical uncertainties are elevating safe-haven demand.

- Gold traditionally performs well during market turmoil.

Trade Policy-Induced Volatility

The disturbances in global markets highlight a return to the volatility linked with trade policy issues that characterized the latter part of Trump’s presidency. The recent slide in U.S. stocks was triggered by threats aimed at eight European countries unless they facilitated a U.S. takeover of Greenland. This move raised concerns over the potential for further trade restrictions affecting global economic growth.

Stock Market Performance

Following Trump’s remarks, U.S. stocks fell to their lowest levels in several months, translating into a significant market downturn. Notable effects included:

- Increased yields on 10-year U.S. Treasury bonds.

- A notable sell-off that the market had not experienced since April.

April had seen a spike in tariffs on various U.S. trade partners. The recent tensions interrupted a period of market stability that had followed a series of trade agreements.

Concerns Over Japanese Bonds

Another contributing factor to the global market upheaval was a significant sell-off in Japanese government bonds. Yields on these bonds have spiked, fueled by concerns over Japan’s fiscal discipline after Prime Minister Sanae Takaichi announced plans for a snap election and tax cuts.

U.S. Treasury Secretary Scott Bessent pointed out that the turmoil in Japanese bonds has impacted U.S. Treasury markets as well. Analysts suggest that if the volatility continues, the Trump administration may need to reconsider its tariff strategies toward Europe to restore financial stability.

Expert Insights

Takahide Kiuchi of Nomura Research Institute voiced concerns about capital flight from U.S. markets. He emphasized the importance of strategic reassessment in regards to tariff policies in order to stabilize financial conditions.