Geopolitical Tensions Grip Stocks as Trump Attends Davos; Bonds Remain Steady

Global markets are experiencing significant volatility as geopolitical tensions rise, with increasing apprehension about the implications of President Donald Trump’s actions and statements. Notably, concerns emerged following Trump’s ongoing rhetoric regarding Greenland and the threat of tariffs on European nations.

Market Overview Amid Fear of “Sell America” Trend

The term “Sell America” has resurfaced among investors, signaling a retreat from U.S. assets. This sentiment, reminiscent of last year’s trade uncertainties, has led to a notable decline in global stock indices.

- Wall Street reported a drop of more than 2% recently.

- The MSCI All-World index fell by 0.12% for its fourth consecutive decline.

- Europe’s STOXX 600 index also faced pressure due to heightened tariff concerns.

Investors have increasingly turned to gold, which reached a new record high of $4,865 per ounce amid fears of instability in U.S. markets. Mantas Vanagas, a senior economist at Westpac, noted that the “sell America” movement has been a profound influence on trading behavior, as confidence in U.S. policies wanes.

Implications of Trump’s Davos Speech

As President Trump prepares to address the World Economic Forum in Davos, market watchers are keenly anticipating how his words will impact U.S.-EU relations. His past comments regarding Greenland have escalated tensions, and fears of tariffs could provoke a broader trade war.

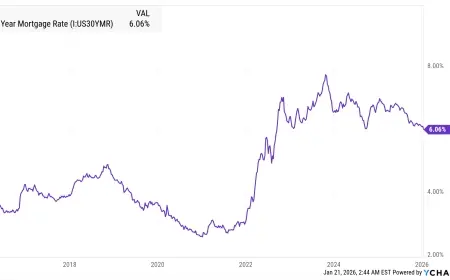

Bond Markets Attempt Recovery

The bond market suffered a significant selloff recently, spurred by fears over U.S. assets and rising borrowing costs in Japan. Long-dated Japanese sovereign bonds experienced their steepest decline in nearly 25 years, driven by concerns over government spending under Prime Minister Sanae Takaichi.

- U.S. 30-year Treasury yields approached the 5% mark for the first time since September.

- German government bond yields also increased sharply during this period.

However, Wednesday saw a rebound in bond prices, with Japanese bonds recovering almost all of their previous losses. U.S. Treasuries mirrored this trend, as 30-year bond yields fell slightly to 4.896%.

Foreign Exchange Market Dynamics

In the forex markets, the U.S. dollar index showed signs of recovery after a tumultuous week, climbing 0.22%. Key currencies reacted variably:

- The euro fell to $1.1711 after a brief increase the day prior.

- The Swiss franc weakened, impacting dollar performance.

- The yen strengthened slightly ahead of a Bank of Japan policy meeting, though no rate hike is anticipated.

Despite the modest recovery in the dollar, oil prices decreased as geopolitical concerns overshadowed temporary halts in production from Kazakhstan. Brent crude futures fell by 1.45%, settling at $63.96 per barrel.

As global tensions continue to shape financial markets, stakeholders remain watchful of developments, especially surrounding President Trump’s statements and potential policy shifts.