Pricing Global Regime Change: Is It Possible?

Recent developments in global politics and economics have stirred significant uncertainty in the markets. U.S. President Donald Trump’s foreign policies and trade actions are creating ripples that may reshape the global landscape. The pressing question is whether these changes will lead to escalation or remain temporary disturbances.

Global Regime Change: The Current Climate

Since 2026, the international scene has seen dramatic shifts. The Venezuelan government has undergone a leadership change, positioning the Trump administration as a key player in Venezuela’s future. In Iran, widespread protests have been met with a violent crackdown, resulting in substantial loss of life. Meanwhile, Trump’s controversial efforts to acquire Greenland from Denmark have raised eyebrows among NATO allies.

Economic Impacts and Market Reactions

The economic ramifications of these geopolitical shifts are becoming apparent. Trump has enacted interventionist policies affecting everything from credit card interest rates to mortgage-backed securities. Additionally, U.S. oil executives are being urged to invest significantly in Venezuela, adding to the complexities of the economic landscape.

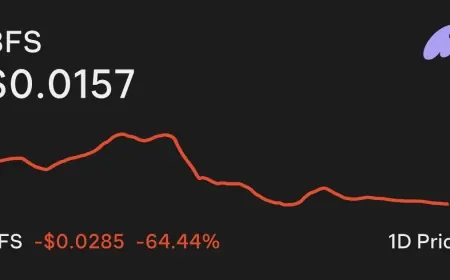

- Stock Market Instability: Increasing tensions with European allies have led to a selloff across stocks, bonds, and the dollar.

- Gold Prices Rising: Gold prices have surged, surpassing $4,700 per ounce, indicating a return to the ‘Sell America’ sentiment among investors.

Anticipated Economic Growth

Despite the disruptions, economic forecasts remain cautiously optimistic. The International Monetary Fund (IMF) has adjusted its 2026 U.S. growth projection to 2.4%, up from 2.1%. This upward revision is partly due to substantial investments in artificial intelligence facilities and energy generation.

- Earnings Performance: Early reports from 33 S&P 500 companies show that 84.8% exceeded earnings expectations, which is encouraging for equities.

- Projected Growth: Analysts predict a year-on-year earnings growth of 9.0%, which could bolster market confidence.

Uncertain Future and Investor Sentiment

The past year’s market stability may have been illusory, sustained by a cycle of passive investment inflows. Investors now face a daunting challenge in accurately pricing risks associated with fundamental shifts in global politics. The potential end of NATO and the emergence of a multipolar world involving the U.S., China, and Russia raises critical questions about future investments.

As Matt King of Satori Insights stated, “For investors, regime change is hard to navigate.” This unpredictability poses challenges for forecasting corporate earnings, especially with looming threats such as excess AI capacity from international competitors. The ongoing geopolitical tensions could ultimately trigger a more significant market correction, particularly if actions like the proposed acquisition of Greenland diverge from investor sentiment.

In conclusion, while the current geopolitical climate poses risks, the underlying fundamentals may provide resilience. The interconnected nature of global finance suggests that navigating these waters will require careful consideration from investors and policymakers alike.