UAE Stablecoin Regulations Transform Daily Banking and Payment Habits

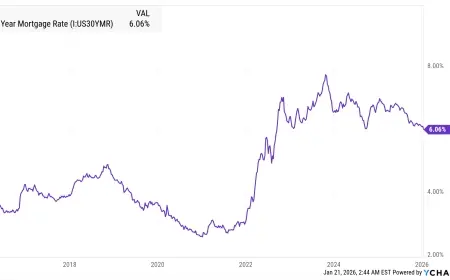

The evolving landscape of banking and payment systems in the UAE has taken a significant turn towards stablecoin regulations. This shift is fundamentally changing how residents and businesses engage in daily financial transactions.

Impact of Stablecoin Regulations on Banking

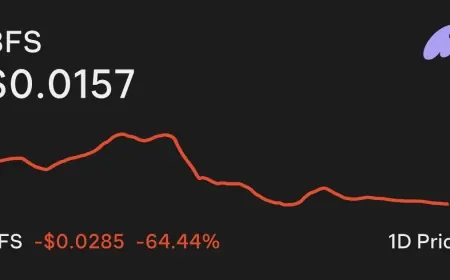

According to a recent analysis by S&P, the introduction of blockchain settlement may lead to a slight decline in payment revenues for banks. The traditional fees associated with payment services and money transfers could see a reduction as stablecoin use expands. However, this loss might be counterbalanced by income generated from new services.

- Wallet services for digital assets

- Holding reserves for third-party issuers

Despite potential revenue changes, S&P maintains that these developments will not significantly impact the credit stability of UAE banks. The regulatory environment is expected to safeguard the banking system’s integrity.

The UAE’s Leading Position in Stablecoin Regulations

The UAE has emerged as a frontrunner in the realm of stablecoin legislation within the Gulf region. While Bahrain permits stablecoins linked to various fiat currencies, countries like Saudi Arabia and Oman are still formulating their regulation frameworks. In contrast, Qatar and Kuwait have adopted more restrictive stances on crypto and stablecoin initiatives.

Globally, the UAE’s regulatory approach aligns with some of the best international practices. Stablecoins in the UAE must adhere to stringent guidelines:

- Fully backed by reserves

- Assets are kept separate from operational funds

- Issuers are required to obtain proper licensing

- Robust supervision is implemented

Digital Dirhams in Everyday Transactions

These regulations are facilitating the introduction of regulated digital dirhams into daily transactions for businesses and residents. This transition promises a secure and efficient payment ecosystem, further integrating digital currencies into the UAE’s economy.

The banking and finance sector in the UAE is on the brink of a transformation that may redefine payment behaviors and business operations. As stablecoins become more commonplace, both consumers and financial institutions will need to adapt to this innovative financial framework.