2026 MENA Crypto Regulations: Comprehensive Legal Guide by Country

The cryptocurrency landscape in the Middle East and North Africa (MENA) is evolving rapidly. A legal guide for 2026 reveals significant differences in regulatory approaches across various countries. This article explores the legal status, frameworks, and market specifics for cryptocurrencies in MENA nations.

2026 MENA Crypto Regulations: Country-by-Country Analysis

The MENA region illustrates a spectrum of regulatory attitudes towards cryptocurrencies, with notable leaders and cautious players.

United Arab Emirates (UAE)

The UAE is at the forefront of crypto innovation in MENA. In September 2025, the Central Bank introduced legislation requiring all crypto and blockchain entities to obtain licenses. Non-compliance could result in fines up to AED 1 billion (approximately $272 million). A grace period for existing users lasts until September 2026.

- Dubai: Operates under the Virtual Assets Regulatory Authority (VARA), facilitating stablecoin and asset tokenization.

- Abu Dhabi: Governed by the Abu Dhabi Global Market (ADGM) and the Financial Services Regulatory Authority (FSRA), focusing on institutional crypto.

Notably, privacy tokens and algorithmic stablecoins are banned in the UAE for 2026.

Saudi Arabia

Saudi Arabia remains cautious regarding cryptocurrencies. While not entirely illegal, the lack of clear regulations places it in a gray area. The Communications & Security Technology Commission is developing regulations for blockchain entities, but clear licensing pathways for Virtual Asset Service Providers (VASPs) are absent.

- Currently, banks cannot facilitate crypto transactions.

- No domestically licensed exchanges exist, forcing users to rely on international platforms.

The government is exploring Central Bank Digital Currency (CBDC) options, though Sharia compliance remains a concern.

Bahrain

Bahrain has adopted a more progressive stance with a comprehensive regulatory framework. The Central Bank of Bahrain (CBB) allows licensed exchanges to operate and requires VASPs to undergo strict anti-money laundering (AML) and counter-terrorism financing (CFT) compliance.

- The CBB and the Fintech & Innovation Unit support digital banking and decentralized finance (DeFi).

Bahrain aligns closely with the UAE in advancing crypto integration while respecting cultural norms.

Qatar

Qatar’s stance on cryptocurrencies shifted dramatically in 2025, moving from a prohibition to developing the Digital Asset Regulatory (DAR) framework. The framework emphasizes asset tokenization and smart contracts.

- Investment in fintech is on the rise.

- Legal recognition of digital assets is being piloted, marking Qatar as a rapidly emerging player in the region.

Kuwait

Kuwait has taken a restrictive approach toward cryptocurrency. Unauthorized mining activities led to over a 50% decrease in electricity usage due to strict enforcement. Currently, there is no licensing framework for VASPs, discouraging crypto trading among the populace.

Oman

Oman’s approach is conservative, with cryptocurrency use generally prohibited. The existing regulations reflect traditional Islamic financial principles, and no significant changes are expected in the near future. CBDC pilots are ongoing, but widespread adoption remains unlikely.

Egypt

In Egypt, cryptocurrency trading is deemed illegal under Islamic finance laws, confirmed by a binding fatwa from the Grand Mufti. Although the Central Bank prohibits crypto transactions, there is ongoing investment in blockchain for governmental use.

North Africa: Morocco, Tunisia, and Lebanon

In Morocco, crypto trading is effectively banned under foreign exchange regulations, and licensed exchanges are absent. Tunisia has a small, yet progressive, crypto community operating within an unregulated context.

- Despite strict prohibitions, some trading occurs unofficially in Tunisia.

- Lebanon experiences increased crypto adoption due to currency collapse, but it lacks an official regulatory framework.

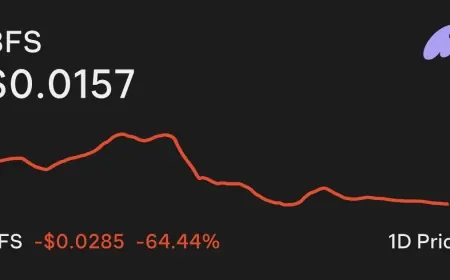

Emergence of Solana in MENA Markets

Solana (SOL) has become a pivotal player in MENA due to its fast transaction speeds and low costs. Its institutional support in the UAE and Bahrain has led to broad acceptance and the establishment of necessary infrastructure.

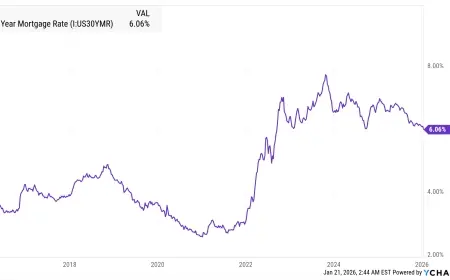

Future Trends in MENA Crypto Adoption

The influence of cultural and religious beliefs complicates cryptocurrencies’ acceptance in the MENA region. While progressive nations like the UAE and Bahrain are leading the way, others remain hesitant.

The future may see a focus on CBDC initiatives, positioning institutional users at the forefront rather than an explosive rise in private crypto usage. With many countries piloting CBDC initiatives, the landscape for cryptocurrencies in MENA will likely evolve significantly in the coming years.