Trump’s Greenland Remarks Spark ‘Sell America’ Trade, Lowering Wall Street and US Dollar

The recent decline of the US dollar and Wall Street can be linked to a combination of factors, primarily driven by what analysts have labeled the ‘sell America’ trade. This trend emerged as investors reacted to former President Donald Trump’s provocative remarks regarding potential trade conflicts with eight European nations over his contentious Greenland takeover proposal.

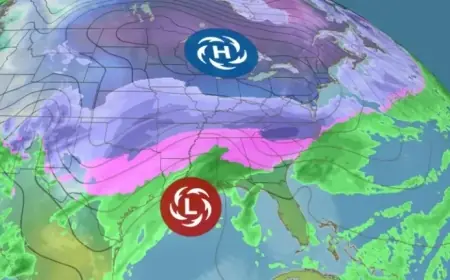

Impact of Japan’s Bond Market on US Financials

Another significant contributor to this financial downturn was the sell-off in Japan’s bond market, which saw borrowing costs reach unprecedented levels. Investors worldwide have traditionally relied on Japan’s low interest rates to finance acquisitions in other markets, including Wall Street. When Japanese rates rise, it often influences a considerable drop in overseas asset values, including those in the US.

Surge in Japanese Government Bond Yields

The situation has escalated as Japanese government bond yields have soared. This spike coincided with Prime Minister Sanae Takaichi’s announcement of a snap election focused on a pro-stimulus agenda. Experts predict this could necessitate increased borrowing by the Japanese government.

- Japan’s 10-year government bond yields increased by nearly 19 basis points in just two days.

- 30-year yields surged by 28 basis points overnight, mirroring the largest daily rise since 2003.

- At 3.883%, the 30-year yield hit its highest point on record.

As bond prices drop due to heavy selling, yields rise to attract potential buyers back to the market. This dynamic directly impacts global bond markets and adds pressure on borrowing costs internationally.

Global Economic Ramifications

Seema Shah, Chief Global Strategist at Principal Asset Management, highlighted the implications of a potential electoral mandate favoring increased fiscal spending in Japan. Such developments could intertwine global financial markets, creating complicated scenarios regarding national debts and rising costs. The current landscape urges investors to stay vigilant in this fluctuating economic environment.