Netflix Revitalizes Warner Bros. Bid to Outsmart Paramount

Netflix has officially modified its acquisition proposal for significant parts of Warner Bros. Discovery, responding directly to Paramount’s ongoing interest in the company. This strategic shift comes as a response to Paramount’s CEO, David Ellison, who is actively pursuing Warner Bros. Following an initial agreement in December for an $83 billion cash-and-stock deal, Netflix has now decided to streamline the offer to an all-cash arrangement. This adjustment alleviates concerns for investors regarding the fluctuations in Netflix’s stock value.

Netflix Revitalizes Bid Amid Competitive Landscape

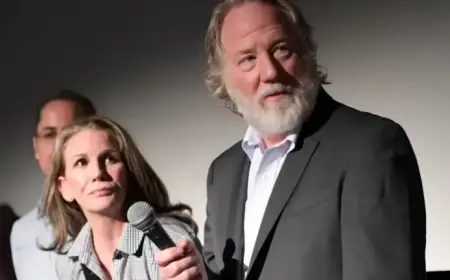

David Zaslav, the CEO of Warner Bros. Discovery, expressed optimism about the revised merger agreement. He highlighted the potential for merging two significant storytelling entities. Ted Sarandos, co-CEO of Netflix, underscored that the new proposal offers “greater financial certainty” for shareholders, which may push Paramount to rethink its strategy after Warner Bros. Discovery rejected its last proposal, citing greater risks associated with it.

The Bid for Warner Bros. Discovery

The struggle for Warner Bros. Discovery has seen intense competition between Netflix and Paramount over recent months. Paramount launched a hostile bid, trying to appeal to Warner Bros. investors after their offers were dismissed in favor of Netflix’s proposal. The transaction’s future is now in the hands of Warner Bros. shareholders, who will ultimately determine the outcome of any potential sale.

Strategic Moves and Financial Details

Warner Bros. Discovery has also announced plans to make adjustments to its business not included in the Netflix deal. The company is spinning off its cable operations, such as CNN and TNT, into a separate publicly traded entity. Paramount argues that this cable division holds no value, asserting that their broader acquisition proposal is more beneficial to shareholders compared to Netflix’s focused offer.

- Under the revised agreement, Warner Bros. Discovery will reduce the debt associated with its cable division by $260 million.

- The valuation of the cable business has been estimated between $1.33 and $6.86 per share.

- Shareholders could add this valuation to Netflix’s offer of $27.75 per share for the remaining assets of Warner Bros. Discovery.

By clarifying the value of its cable business, Warner Bros. Discovery intends to support shareholders in making informed decisions between Netflix’s and Paramount’s competing proposals. Paramount’s offer stands at $108 billion, which translates to $30 per share.

Regulatory Implications and Political Influence

Netflix’s move to an all-cash offer is anticipated to accelerate regulatory review by the Securities and Exchange Commission. This could result in a swifter voting process among Warner Bros. Discovery shareholders. Meanwhile, both competing companies are reaching out to Washington politicians, including President Trump, to gain favorable attention for their respective bids. Trump has indicated he would take an active role in the deal and has recently shared support for Paramount’s position, while praising Netflix’s Sarandos.