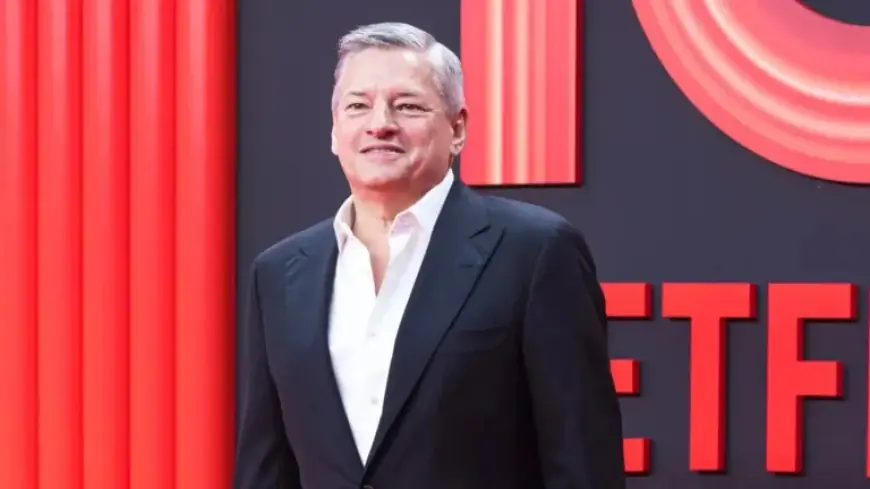

Warner Prioritizes Deal Success or Box Office Hits?

In a high-stakes battle for media dominance, Netflix is prioritizing the success of its ongoing deal negotiation with Warner Bros. Discovery (WBD) over other potential box office hits. Following a monumental agreement where Netflix intends to acquire WBD’s studios and streaming ventures for $82.7 billion, the company faces pressure from competitors and fluctuating stock performance.

Investor Concerns Amid Ongoing Negotiations

Share prices for Netflix reflect investor uncertainty. After peaking at $103.22 just before the announcement, the stock fell to $88.05—down by 15%. As Netflix prepares to release its fourth-quarter and full-year 2025 results, analysts are focused on how the company will address both financial performance and the implications of the WBD acquisition.

Analysts Weigh In on Netflix’s Earnings Report

- Alicia Reese from Pivotal Research Group noted a price target adjustment to $115, driven by ongoing M&A concerns.

- Brian Pitz of BMO Capital Markets maintained a target of $143, predicting a solid quarter boosted by popular titles like *Stranger Things*.

- Laurent Yoon from Bernstein mapped out a positive outlook for 2026, despite short-term M&A distractions.

- John Blackledge at TD Cowen anticipates net additions of 14.2 million paid subscribers due to seasonal boosts.

- Benjamin Swinburne from Morgan Stanley acknowledged the complexities of WBD’s integration while retaining an “overweight” rating.

Overall, analysts largely anticipate Netflix will report steady subscriber growth and solid earnings, yet fears remain regarding the impact of the WBD acquisition on Netflix’s long-term operational strategy.

Potential Challenges and Opportunities

The heightened competition from Paramount, which has launched a hostile bid for WBD, adds complexity to the situation. Paramount has challenged Netflix’s offer and plans to intensify its bid, which may necessitate Netflix to reassess and potentially increase its current proposal of $27.75 per share.

The acquisition process presents both opportunities and challenges. Analysts predict that Netflix’s ad revenue could become a major growth driver by 2026, supported by rising content investments. However, this higher spending comes with the need for evidence of effective execution in its advertising strategy to justify such investments.

Conclusion: Navigating the M&A Landscape

As Netflix prepares for the upcoming earnings call, the focus remains on how it plans to merge WBD’s robust portfolio with its existing services. Investors are likely to keep a close eye on guidance for 2026 while weighing the implications of any updates regarding the Warner deal.

Ultimately, the outcome of the ongoing negotiations will significantly shape Netflix’s future stability and growth trajectory, while also determining its position in a rapidly evolving media landscape.