Robin J Brooks Analyzes Japan’s Economic Crisis

The Japanese Yen is nearing its lows against the US Dollar, with trade-weighted measures showing even greater depreciation. This situation arises amid calls for official intervention by Japan’s Ministry of Finance (MoF), although historical attempts suggest that such measures may prove ineffective.

Factors Contributing to Japan’s Economic Crisis

The Japanese Yen’s decline can be attributed to the lack of necessary increases in interest rates. Currently, these rates remain at artificial lows and do not adequately compensate investors for the perceived increasing risk of default. The pressing need for higher interest rates emphasizes Japan’s precarious financial position.

Government Debt and Yield Trends

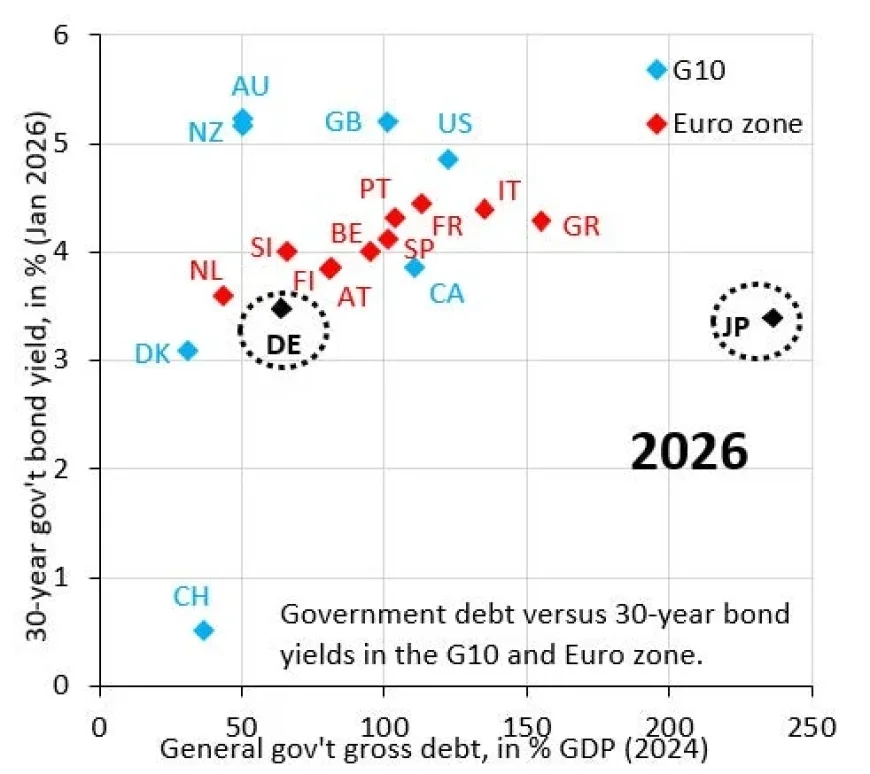

Japan’s economic situation is further complicated by its substantial government debt. A comparison with Germany reveals the stark differences in yields and debt levels:

| Country | Gross Debt (% of GDP) | 30-Year Government Bond Yield |

|---|---|---|

| Japan | 240% | Below market expectations |

| Germany | Far below Japan | Above Japan’s yield |

Despite rising yields in Japan, they remain insufficient relative to the staggering levels of government debt. The Bank of Japan (BoJ) plays a critical role in this scenario by purchasing government debt, keeping yields artificially low. This situation heightens the depreciation pressure on the Yen.

The Dilemma of Rising Yields

Allowing interest rates to rise could precipitate a fiscal crisis for Japan. A retreat by the BoJ from bond purchasing could lead to unpredictable yield increases, exacerbating the current economic challenges.

A Potential Solution

- Japan’s net debt stands at 130% of GDP.

- Gross debt is around 240% of GDP.

- Japan’s government possesses considerable assets that could be liquidated.

A viable pathway for Japan could involve selling government assets to help reduce gross debt levels. While some assets are illiquid and cannot be quickly sold, even small gestures towards this strategy may provide substantial benefits for the Yen. Ultimately, relying on official FX intervention will likely yield limited results, and Japan must explore more sustainable solutions to its ongoing economic crisis.