Gold Options Traders Increase Long Positions

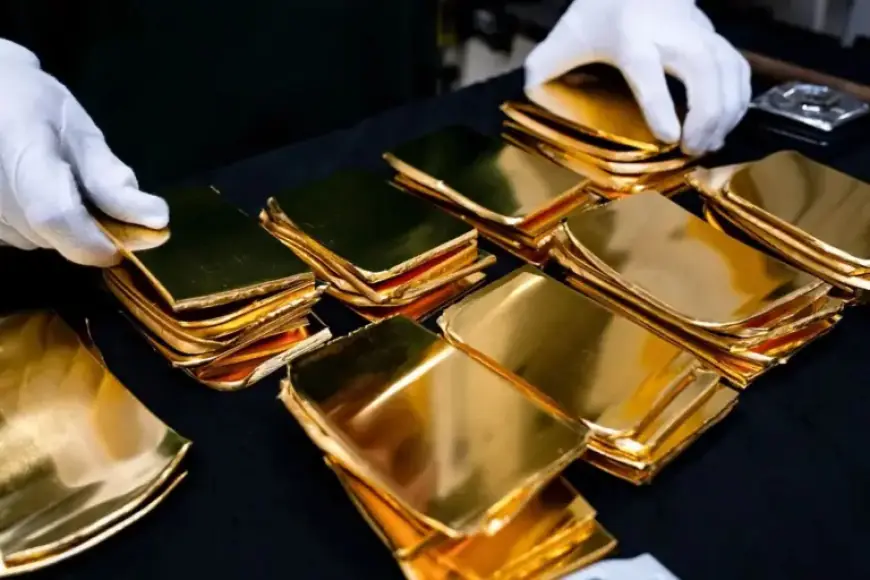

Gold options traders are demonstrating renewed confidence amid fluctuating market conditions. Despite a significant correction in the gold market, many investors continue to increase their long positions, anticipating another price surge.

Market Overview

In late January, gold bullion futures reached an astonishing record high of over $5,600 per ounce. However, the market experienced an unprecedented decline shortly after. This volatility has not deterred bullish investors.

Investor Activity

- Investors have begun purchasing December call spreads priced at $15,000 and $20,000.

- These transactions occurred on the CME Group’s Comex exchange.

- Currently, around 11,000 contracts of this position have been established.

Future Predictions

Despite the recent downturn, the increase in long positions suggests that traders expect gold prices to ultimately rebound. Many believe that the market will reach previously unimaginable heights.

As gold options traders remain optimistic, their actions reflect a broader confidence in the long-term value of gold. The ongoing activities in the market indicate a strategic bet on future price increases.