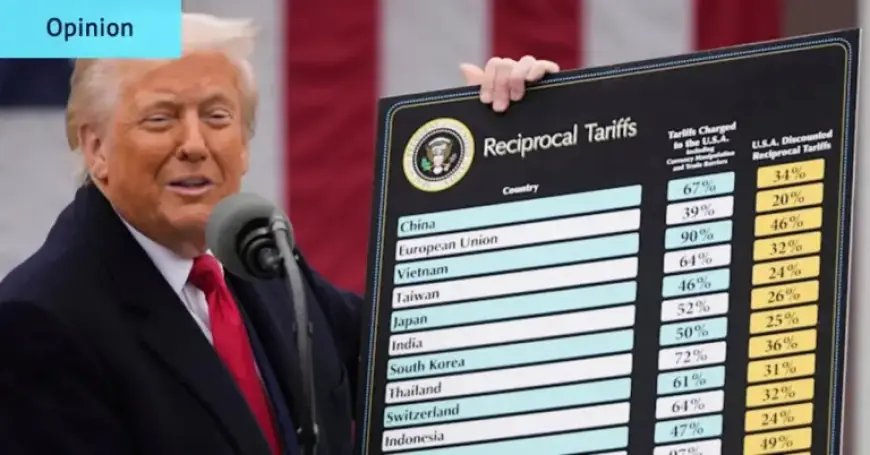

Trump Misleads on Funding Sources for Global Conflict

The Trump administration is contemplating potential adjustments to tariff policies on imported steel and aluminum. These tariffs, initially set at 25% and later increased to 50%, were implemented shortly after Trump resumed office in 2025. An important question arises: why change these tariffs if the burden is supposedly on foreign exporters?

Tariff Impact on Consumer Goods

The tariffs extend beyond raw materials; they encompass “derivative” products, affecting various consumer goods. Items like washing machines, bicycles, and food cans are also subject to these tariffs. As a result, importers have expressed concerns over the intricate calculations required for compliance.

Shift in Administrative Stance

The Trump administration has shown heightened awareness of the tariffs’ effect on consumer prices, especially with midterm elections approaching. Recently, US Treasury Secretary Scott Bessent acknowledged contemplating a “clarification” of the tariffs without elaborating further.

Economic Studies Contradict Claims

Despite the administration’s assertions that exporters bear the tariff costs, studies from credible institutions challenge this narrative. A comprehensive analysis from Germany’s Kiel Institute, covering over 25 million shipment records, showed that foreign exporters absorbed only about 4% of the tariff costs. The effects on trade volumes were significant, as exporters redirected sales to different markets without decreasing their prices.

US Companies and Consumers Bear the Burden

Additionally, research from the New York Federal Reserve highlighted that, after various exemptions on tariffs, the average US tariff rate rose from 2.6% to 13% by year-end. In the first eight months of that year, US importers incurred 94% of the tariff costs, which slightly decreased to 86% later on, suggesting adjustments in pricing strategies or supply chains.

Sector-Specific Effects of Increased Tariffs

- Boost in imports from Mexico and Vietnam contrasted with a decline from China.

- Average tariff rate yields increased import prices by 11% compared to non-tariff goods.

- Estimates indicated a 30% absorption of price increases by US businesses, leaving 70% passed on to consumers.

Broader Economic Consequences

The Congressional Budget Office (CBO) weighed in on these rising tariffs, predicting short-term inflation increases and subsequent economic impacts, including reduced real GDP and employment levels. The office reported that the combination of direct and indirect costs from tariffs leads to a complete pass-through of expenses to consumer prices.

Inflation and Tariff Connections

Recent data indicated an unexpected decline in the overall inflation rate, recorded at 2.4%. Nevertheless, many economists contend that the tariffs could potentially raise inflation by nearly one percentage point. The external factors contributing to subdued effects in pricing include fluctuating dollar values and inventory levels built before the tariffs.

Conclusion

With compelling analyses from multiple esteemed sources indicating that the bulk of the tariffs’ costs ultimately fall on US consumers, significant questions remain regarding the administration’s tariff strategy. As both economic conditions and political timelines evolve, the implications of these tariffs on consumer pricing are crucial to monitor.