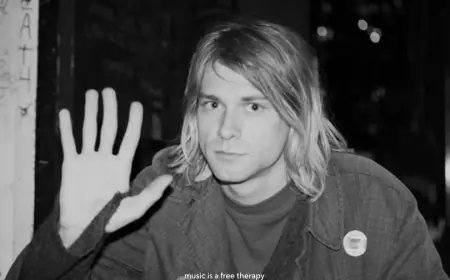

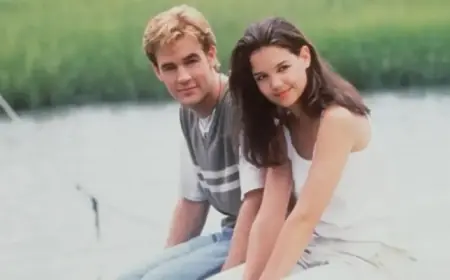

James Van Der Beek Net Worth: Why Estimates Vary Sharply After the Actor’s Death and What His Fortune Likely Looked Like

In the hours after news broke that James Van Der Beek had died at 48, public attention quickly shifted from tributes to a more uncomfortable question: what was James Van Der Beek’s net worth, and why would a family of seven need an emergency fundraising drive at all? As of Thursday, February 12, 2026 ET, widely circulated online estimates for his wealth are inconsistent, clustering in a broad band that generally lands in the low single-digit millions, with some claims running higher.

The uncomfortable reality is that celebrity net worth numbers are rarely audited, often outdated, and especially unreliable when a person has faced a prolonged illness, uneven work years, private real-estate decisions, and large medical bills.

James Van Der Beek net worth: the most realistic range, and why it’s not a single number

A reasonable way to frame James Van Der Beek’s net worth at the time of his death is as a range rather than a single figure: roughly a few million dollars on the low end to mid single-digit millions on the high end. That spread exists because different estimates make different assumptions about three things that are usually private:

-

How much cash or liquid savings was on hand versus tied up in property or long-term investments

-

How much ongoing income still flowed from past work, including residuals and licensing arrangements

-

How much financial leakage occurred from medical expenses, insurance gaps, travel for care, and time away from work

Even when someone has had a long, visible career, net worth can swing dramatically based on timing: a good year of work plus a property upswing can inflate wealth, while a health crisis can drain it faster than the public assumes.

What built his fortune: legacy roles, working actor economics, and the long tail of residuals

Van Der Beek’s financial base was built the way many long-running television stars build wealth: a signature role that created years of visibility, followed by steady work across film, TV, and guest appearances. That career shape typically creates two income streams:

-

Front-end pay from acting jobs, which can be strong but highly variable year to year

-

Back-end residual income that can last for years but usually declines over time and depends on contract terms and distribution formats

The key point is that residuals are not a guaranteed, constant annuity. For many actors, residual income is meaningful but not “forever money,” especially as viewing habits and distribution deals evolve.

The hidden balance sheet: real estate, lifestyle choices, and the cost of a quieter life

In recent years, Van Der Beek was widely associated with a move away from the traditional celebrity hub lifestyle into a more family-centered, rural setup. Moves like that can be financially prudent, but they can also make wealth look bigger on paper than it feels day to day.

Why? Because a family home, land, and improvements can represent substantial value, but they are illiquid. A household can be “asset rich” and “cash tight” at the same time, particularly with six children and high ongoing costs. If medical treatment becomes a full-time focus, the pressure intensifies: fewer working days, higher out-of-pocket costs, and a greater need for immediate cash rather than long-term equity.

Behind the headline: why a family fundraising drive doesn’t automatically mean “he was broke”

A major online fundraising campaign that accelerates quickly after a death often triggers a simplistic conclusion: that the person had no money. That conclusion is frequently wrong.

Here are the more realistic explanations that fit the situation without assuming financial irresponsibility:

-

Medical costs can be enormous even for insured families, especially with extended treatment over many months

-

Income disruption matters; if work slows, cash flow can collapse even if assets exist

-

Estate timing matters; assets can be tied up in probate and taxes, leaving survivors short on immediate liquidity

-

Childcare, schooling, and housing stability become urgent priorities when a spouse is suddenly the sole parent

Incentives also shape these moments. Friends and supporters may launch fundraising because it’s the fastest way to stabilize a family’s next 90 days, regardless of what the long-term estate value eventually proves to be.

What we still don’t know: the missing pieces that determine the “real” net worth

The public does not have verified access to the information that would pin down a precise James Van Der Beek net worth figure. The biggest unknowns include:

-

Any outstanding medical debt and the terms of coverage

-

The true market value and debt load of any real estate holdings

-

The structure of royalties and residual arrangements from legacy projects

-

Legal costs and outcomes tied to past business disputes or contract claims

-

Estate planning details that affect taxes, access, and timing of distributions

Without those inputs, any exact number is best treated as an estimate, not a fact.

What happens next: realistic scenarios that will shape the final financial picture

Over the next several months, the family’s financial reality will be shaped by a few predictable triggers:

-

Estate administration and timelines for transferring assets to the surviving spouse and children

-

Potential sale, refinance, or restructuring of property to increase liquidity

-

Ongoing inflows from residuals and licensing that may continue but are hard to forecast publicly

-

The fundraising campaign’s impact in covering short-term costs and preventing forced decisions

-

Any final medical billing resolutions and negotiated reductions

Why it matters: beyond the celebrity lens, this story exposes how fragile household finances can become when serious illness collides with variable income, even for a recognizable name. The public number called “net worth” is often the least useful measure of whether a family can pay next month’s bills.