Sanofi Dismisses CEO Hudson Amid Stalled Vaccine Turnaround Efforts

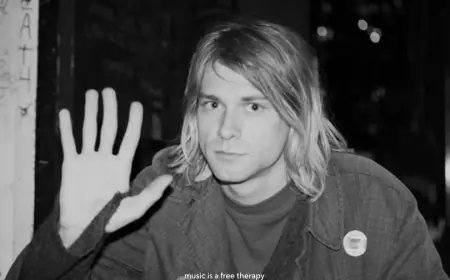

Sanofi, the French pharmaceutical giant, has made significant leadership changes as it grapples with challenges in its vaccine sector and product pipeline. Paul Hudson, the CEO since 2019, is set to leave the company on February 17, 2024. His departure comes amid stalled efforts to replace declining blockbuster drugs and increasing pressures related to vaccine sales in the United States.

Leadership Transition at Sanofi

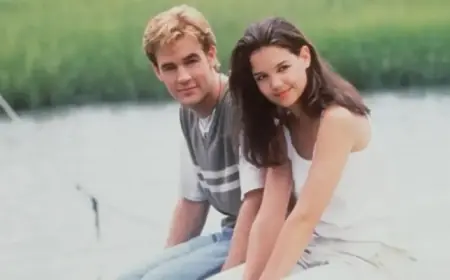

Belén Garijo, currently the CEO of German drugmaker Merck KGaA, has been appointed as Hudson’s successor. She will officially assume the role at the end of Sanofi’s shareholder meeting on April 29, 2024. Garijo brings a wealth of experience, having previously served on Sanofi’s board for 15 years.

- Hudson’s tenure came to an end due to stalled progress on drug development.

- Garijo aims to enhance the company’s strategy and lead a new growth cycle.

Sanofi’s Vaccine Sales and Market Pressures

Sanofi has been facing rising pressure from evolving vaccine policies in the U.S., which have impacted sales. The company anticipates that its vaccine division sales will be “slightly negative” in 2026. This downturn follows a string of disappointing trial results that have brought down the company’s shares by approximately 25% over the past year.

Investors have reacted negatively to these developments, leading to a nearly 6% drop in Sanofi’s share price following the announcement of Hudson’s exit. Analysts noted that while Garijo has a credible background, her profile may not have aligned with previous expectations for a successor.

Future Prospects and Strategic Goals

Under Hudson, Sanofi focused on diversifying its portfolio, especially with the impending patent expiration of Dupixent, a key asthma and eczema treatment. Despite earlier optimism, the company has not managed to sufficiently develop new drugs to replace this revenue stream.

Going forward, Garijo’s leadership will be crucial in steering Sanofi towards its “next growth cycle.” The company has indicated plans for potential dealmaking in the vaccine sector, which could shape its strategy moving forward.

Performance Overview since 2019

Since Hudson took over in 2019, Sanofi has delivered a 33% return for shareholders, including dividends. However, this pales in comparison to rivals such as AstraZeneca and GSK, which posted significantly higher returns of 133% and 65%, respectively, during the same timeframe.

As Garijo prepares to lead Sanofi, her success will largely depend on addressing the company’s pipeline issues and leveraging its strengths in the vaccine market.