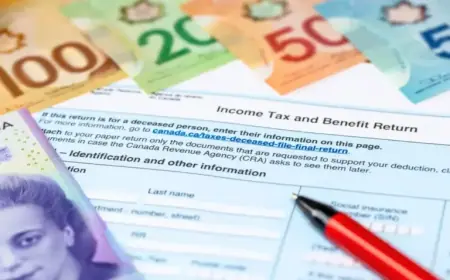

Stellantis Sells Windsor Battery Plant Stake to Korean Investors for $100M

Stellantis NV has divested its 49% stake in a Canadian battery plant, Windsor, for $100 million. This move comes amid the company’s reported losses of $26.5 billion in electric vehicle (EV) investments. The Windsor plant, which was part of a joint venture with South Korean firm LG Energy Solution, will now be solely owned by LG Energy.

Details of the Transaction

The Windsor battery plant is located in Ontario, Canada, and plays a crucial role in Stellantis’ EV supply chain. With this sale, Stellantis hopes to ensure a steady supply of EV batteries for its vehicles while enabling LG Energy Solution to optimize the plant’s production capacity.

- Transaction Amount: $100 million

- Stellantis Stake: 49%

- Employee Count: Over 1,300 (with plans to expand to 2,500)

Future Production Plans

LG Energy Solution aims to ramp up production at the Windsor site significantly. CEO David Kim expressed confidence in the opportunities this acquisition presents. “We see growth opportunities in North America by situating a key production hub in Canada,” he stated.

Impact on Stellantis

This divestment comes during a challenging period for Stellantis. Reports indicate a dramatic fall in the company’s stock, down nearly 25% on New York and Milan exchanges. This slump reflects broader struggles within the auto industry as demand for EVs has not met expectations, leading to significant financial losses.

Stellantis has also modified its production strategy, canceling certain electric models and transitioning to energy storage products at underutilized battery plants.

Industry Context

The sale of the Windsor battery plant is part of a larger trend, with several automakers re-evaluating their investment in EV technologies amidst fluctuating demand.

- General Motors: Sold its stake in Lansing Ultium Cells LLC, recovering $1 billion.

- Ford Motor Company: Dissolved its joint venture with SK On and is transitioning to wholly-owned subsidiaries.

Understanding these moves is crucial as the automotive industry navigates the complex landscape of electric vehicle production and investment strategies.