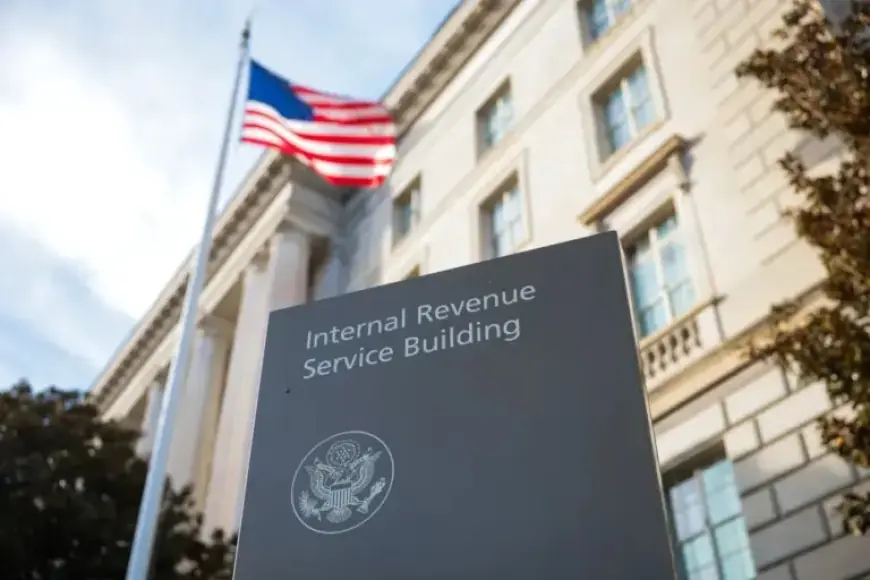

Delayed Tax Refunds: Millions of Americans Face Payment Holdups

Recent changes by the Internal Revenue Service (IRS) may lead to delayed tax refunds for millions of Americans. In a significant shift, the IRS is moving away from issuing paper checks, encouraging taxpayers to utilize direct deposit for their refunds.

Impact of Direct Deposit Implementation

As of 2025, the IRS processed over 93.5 million tax refunds. Notably, 93% (around 87 million) of these refunds were issued via direct deposit. This indicates that approximately 6.5 million Americans will need to provide their direct deposit information to avoid delays.

Details of the New Refund Protocol

- The IRS will process tax returns without direct deposit information but will temporarily freeze refunds.

- Taxpayers must provide their direct deposit details or request a paper check to unlock their refund.

- Most rejected direct deposits will not automatically be issued as paper checks, risking delays of several weeks.

In situations where a refund is frozen, the IRS sends out a CP53E notice. Taxpayers have 30 days to respond, after which an additional six weeks may pass before a paper check is issued.

Concerns About Older Taxpayers

Experts express concerns about the impact of this transition on older taxpayers. Many may struggle with adding their direct deposit information. Kevin Thompson, CEO of 9i Capital Group, noted that while modernization is crucial, it may require more effort from families, especially those less comfortable with technology.

Voices from the Financial Community

Financial literacy instructor Alex Beene highlighted the potential for errors in entering direct deposit information. Incorrect routing or account numbers can lead to frozen refund amounts. However, he reassured taxpayers that the IRS would communicate about these issues and provide a window to correct them.

Michael Ryan, a finance expert, emphasized the real financial impact of delayed refunds, particularly for those living paycheck to paycheck. Even a short delay could be detrimental, affecting essential expenses like rent or debt payments.

Steps to Avoid Delays

- Double-check bank routing and account numbers before filing taxes.

- Select direct deposit for a faster refund process.

Despite ongoing partial government shutdowns, taxpayers are reminded of their obligation to file taxes by April 15. According to Thompson, the IRS is funded through the Inflation Reduction Act until early February, but timely filing remains critical.

Understanding the changes surrounding tax refunds is vital for Americans this season. By being proactive and ensuring accurate direct deposit information, taxpayers can avoid potential delays and receive their refunds promptly.