Scotiabank, CIBC, National Bank Back International Defence Bank Initiative

Several prominent Canadian banks have pledged their support for a new multinational initiative aimed at financing defense projects. This marks a significant shift in the attitudes of Canadian financial institutions towards the defense sector, which has often been overlooked.

Key Banks Supporting the Defence Bank Initiative

Scotiabank, CIBC, and National Bank have joined forces with Royal Bank of Canada in backing the Defence, Security and Resilience Bank (DSRB). Together, these institutions form four of the nine founding banks of this initiative, which also includes international players such as:

- JPMorgan Chase & Co.

- ING Group NV

- Deutsche Bank

- Commerzbank AG

- Landesbank Baden-Württemberg

Statements from Canadian Bank Leaders

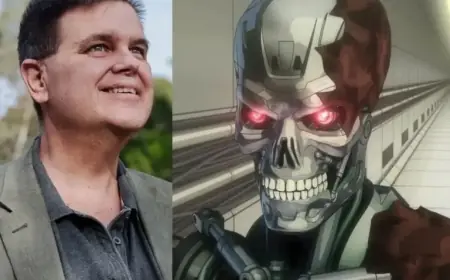

Scott Thomson, CEO of Scotiabank, emphasized that the bank aims to contribute to a safer world through this initiative. He noted that their support aligns with investments aimed at bolstering critical sectors, including defense and security.

Similarly, Harry Culham, CIBC’s CEO, highlighted rising opportunities within the defense sector as a motivating factor for their participation.

Government Endorsement and Discussions

Canada’s government has also officially endorsed the DSRB. Finance Minister François-Philippe Champagne recently expressed satisfaction with the nation’s role in discussions with over ten countries about the bank’s establishment. This includes a virtual meeting of thirteen nations held in Ottawa.

Isabelle Hudon, the CEO of the Business Development Bank of Canada, is serving as Canada’s chief negotiator. She will engage in ongoing discussions regarding the bank’s charter and geographical location.

Funding Considerations

Canada’s financial contribution to the DSRB is expected to exceed $1 billion, although this figure is currently under review. Initial investments from NATO allies will count towards their pledge to allocate 5% of GDP to defense spending.

Challenges for Defense Companies in Canada

Canadian defense firms have historically faced difficulties in securing funding. Many banks have adhered to strict environmental, social, and governance (ESG) standards that often discouraged investments in the defense industry. This has contributed to a negative perception of the sector.

Future Plans for the DSRB

The DSRB Development Group welcomed Canada’s commitment to this initiative. They are collaborating closely with Canada and other allies to develop the bank’s operational framework and governance structure.