Top Dividend Stock Pick for 2026 Revealed

Brookfield Asset Management is emerging as a leading dividend stock pick for 2026 and beyond. This company is often considered underrated yet manages to offer substantial annualized returns. Brookfield distributes nearly 90% of its earnings as dividends, making it highly attractive for income investors.

Investment Goals and Growth Projections

With over $1 trillion in assets under management (AUM), Brookfield is strategically positioned to grow. The company, which manages capital for institutional clients such as pension funds and insurance companies, is significantly expanding its fee-bearing capital, currently at around $580 billion. Brookfield aims to double this figure by 2030, targeting an ambitious 20% annual earnings growth rate during this period.

Core Business Model

Brookfield operates under a relatively stable business model that resembles a toll booth. It earns fees through long-term contracts and diverse asset classes, ensuring consistent revenue regardless of economic fluctuations.

Key Growth Catalysts

The company’s growth is driven by multiple factors:

- Digitalization: The need for data centers is skyrocketing, with McKinsey estimating nearly $7 trillion in capital required by 2030.

- Decarbonization: Brookfield is a leader in renewable energy, enhancing its growth potential.

- Credit Sector Expansion: Brookfield’s credit division, which has grown significantly in the past decade, aims to expand fee streams dramatically by 2030.

Recent Developments

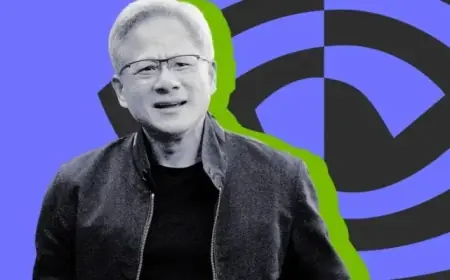

Brookfield has closed two significant deals aimed at capitalizing on the AI boom:

- A $100 billion global AI infrastructure fund in collaboration with Nvidia and the Kuwait Investment Authority.

- A $20 billion joint venture focusing on AI infrastructure in Qatar with Qai.

Financial Performance and Future Outlook

In its most recent quarter, Brookfield raised a record $30 billion in capital and deployed $23 billion. This contributed to a 17% year-over-year increase in fee-related earnings, reaching an all-time high of $754 million.

Looking ahead, Brookfield’s pursuit of another 100% growth in earnings by 2030 seems feasible. Investors who buy into Brookfield today could anticipate annual dividend growth exceeding 15% from 2026 to 2030, powered by a current dividend yield of 3.5%.

Conclusion

Brookfield Asset Management stands out as a prime dividend stock for 2026. Ongoing growth in earnings and significant dividends make it a smart investment choice for those seeking reliable returns in the coming years.