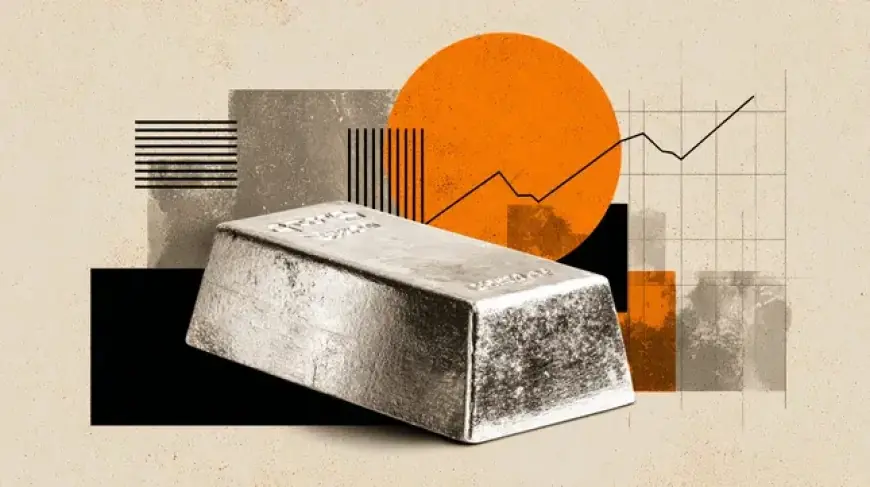

Gold Price Outlook: XAU/USD Steadies Near Record $5,600 High

Gold prices continue to soar, with the XAU/USD pair stabilizing near a remarkable high of $5,600. This interest in gold has persisted for nine consecutive days, marking a notable 20% rise over a two-week period. As of Thursday, the price hovered around $5,535, nearing the record of $5,598. The ongoing strength of gold is closely tied to the weakness of the US Dollar.

Factors Driving Gold’s Ascent

A combination of factors is adversely affecting the US Dollar, leading investors to flock toward gold as a safe haven. Notably, geopolitical tensions have risen, particularly due to the recent military threats issued by the US towards Iran. These developments have further escalated investor demand for gold.

Technical Analysis

- XAU/USD has rallied significantly, creating a potentially overstretched market situation.

- Current resistance levels are at $5,600, while an upward target could reach $5,810 based on Fibonacci retracement levels.

- Support levels can be found at $5,445 and further down at $5,235.

Indicators are signaling that the market may be due for a correction, as the Relative Strength Index (RSI) has reached around 85, suggesting overbought conditions. Despite this, bullish momentum remains strong.

The Role of Gold as a Safe Haven

Gold has long been recognized as a critical asset throughout history, primarily valued for its stability and allure. In modern times, it serves as a hedge against inflation and currency depreciation, making it an essential part of many investment strategies.

Central Bank Holdings and Purchases

- In 2022, central banks collectively acquired 1,136 tonnes of gold, valued at approximately $70 billion—marking the highest purchases on record.

- Emerging economies, including China, India, and Turkey, have been aggressively increasing their gold reserves to bolster currency strength.

Central banks regard high gold reserves as a sign of economic stability, enhancing credibility in times of financial uncertainty.

Relationship Between Gold and the US Dollar

The price of gold is inversely correlated with the US Dollar and US Treasury yields. Generally, when the dollar weakens, gold prices tend to increase. This relationship is crucial for investors seeking to diversify their asset holdings, especially during volatile market conditions.

Market fluctuations can intensify gold prices based on various factors such as geopolitical instability and economic recession fears. As a non-yielding asset, gold typically appreciates in value during periods of lower interest rates, while higher rates can suppress its price. Ultimately, the direction of the US Dollar plays a pivotal role in determining gold price movements.