Wall Street Delivers Exciting News to Palantir Investors

Investors face a critical decision regarding Palantir Technologies (NYSE: PLTR) amid discussions of its valuation and growth potential. The data analytics firm has witnessed a staggering 2,190% increase in its stock price over the past three years. However, it has also experienced substantial volatility, with declines of at least 20% occurring on ten separate occasions. Notably, Palantir’s stock plummeted more than 80% between early 2021 and early 2023, showcasing that investing in this company is not for the risk-averse.

Wall Street Sees Potential in Palantir

Currently, Palantir’s valuation raises eyebrows, trading at 388 times its earnings and 116 times its expected earnings for the upcoming fiscal year. Despite this, Citi analyst Tyler Radke recently maintained a “buy” rating for Palantir, suggesting that it may still be a valuable investment opportunity. Radke increased his price target to $235 per share, indicating a potential gain of 42% based on recent closing prices.

Breaking Traditional Valuation Models

Radke argues that Palantir has defied conventional valuation standards, which are often used to assess software companies. He highlighted the company’s “vicious growth acceleration” and impressive margin expansion as key indicators that it remains undervalued. The increasing demand for Palantir’s Artificial Intelligence Platform (AIP) has further fueled this growth.

- Palantir’s government segment is expected to grow by 51% due to rising defense budgets.

- Projected total revenue growth might reach between 70% and 80% by 2026.

In its recent quarter, Palantir reported a 63% year-over-year revenue increase, with the U.S. commercial sector—primarily driven by AIP—growing a remarkable 121% year-over-year. This segment now contributes 34% to the company’s total revenue.

Strong Foundations for Future Growth

Palantir’s remaining performance obligation, which refers to unrecognized revenue from existing contracts, surged by 65% to $2.6 billion. This figure indicates robust future revenue prospects.

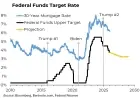

Management has increased its revenue forecast, now anticipating a 53% full-year increase, reaching approximately $4.4 billion. The U.S. commercial revenue alone is projected to rise at least 104%, totaling $1.43 billion.

Investment Strategies for Palantir Stock

Palantir’s volatility suggests that caution is warranted. For investors willing to engage with some risk, the favorable trends in AI and defense could present significant growth catalysts over the next year. For those hesitant about its high valuation, starting with a small investment can be a prudent way to taper risk. Implementing a dollar-cost averaging strategy may also help investors build up their holdings over time, enabling them to buy more shares when prices dip.

Overall, as Wall Street continues to deliver exciting news to Palantir investors, the company’s future remains bright, provided they navigate the inherent risks wisely.