Dollar Plummets Again Following Brief Rally Yesterday

The dollar is experiencing significant challenges after a brief rally. President Trump described the currency as “doing great,” yet his endorsement has done little to bolster the dollar’s declining status. The sentiment surrounding the greenback continues to deteriorate, with various factors contributing to its downturn.

Key Contributors to Dollar’s Decline

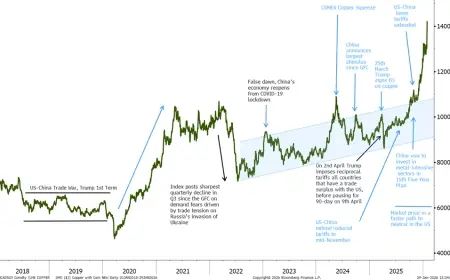

Several elements are weighing heavily on the dollar:

- Trade Policy Uncertainty: Incoherent trade approaches and tariffs remain a concern.

- Geopolitical Instability: An erratic foreign policy contributes to market insecurity.

- Federal Reserve Issues: Perceived undermining of the Fed’s independence is impacting investor confidence.

- Fiscal Concerns: Rising global fiscal worries are leading to currency debasement.

Current Market Highlights

As of today, the pressure on the dollar continues. The euro is up 0.3% against the dollar, trading at 1.1990. This marks the highest level for the EUR/USD pair since June 2021. The USD/CHF pair is down 0.4% to 0.7650, nearing fresh 15-year lows.

Additionally, boosted by strong inflation data, the Australian dollar (AUD) has risen 0.7%, reaching 0.7090. This is its highest point in two years.

Precious Metals Surge

Today’s most significant movements are seen in precious metals. Gold has surged by 2.5%, now priced at $5,555. Over the week, it has increased by over 11%. Just last week, discussions centered around whether gold would surpass the $5,000 mark. Now, it approaches $5,600.

Silver has also seen remarkable growth, rising more than 1% to a new record above $118, showcasing an unyielding market trend.

Conclusion

The dollar’s trajectory remains vulnerable due to ongoing economic and geopolitical pressures. As market dynamics shift, both foreign exchange traders and investors in precious metals are adapting to a landscape characterized by volatility and uncertainty.