Stock Poised to Lead Market by 2026’s End, Analysts Predict

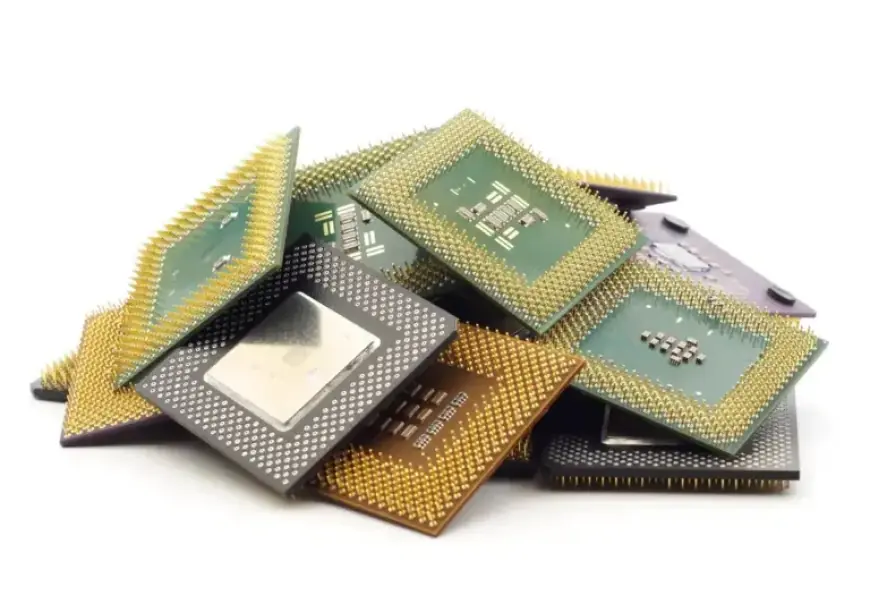

Micron Technology is strategically positioned to lead the memory market as demand for memory hardware surges. The company has emerged as a frontrunner in addressing the growing needs of the artificial intelligence (AI) sector. With generative AI software evolving rapidly, the demand for memory components such as RAM and DRAM is set to increase significantly.

AI and Memory Demand

Generative AI, including notable software like OpenAI’s ChatGPT, has introduced substantial challenges in terms of memory capacity. The market is facing a critical shortage of RAM. Analysts predict that by the first quarter of 2026, prices for memory components could soar by 50% due to this demand imbalance.

Micron’s Growth and Position

Based in Boise, Idaho, Micron has seen its stock price rise by an astonishing 277% over the past year. The company’s focus has shifted away from the consumer memory sector to capitalize on the burgeoning need for AI memory solutions. This strategic pivot positions Micron favorably to benefit from ongoing market trends.

Financial Highlights

- Current Price: $19.07

- Market Cap: $462 billion

- Volume: 622K shares

- 52-Week Range: $61.54 – $435.68

- Q1 Fiscal 2026 Revenue: $13.6 billion (57% increase YOY)

- Gross Margin: 45.3%

Micron’s revenue growth is largely driven by its cloud and data center segments. Notably, DRAM sales made up 79% of its quarterly revenue and increased by 69% year-over-year, highlighting the demand for memory as AI technology continues to advance.

Market Valuation

The company’s forward GAAP price-to-earnings ratio stands at 11.6, significantly lower than the sector median of 31.1. This discrepancy indicates robust growth potential, suggesting that Micron is undervalued relative to its performance.

Future Prospects

As Micron continues to meet the escalating demand for AI memory, it is well-positioned to solidify its status as a market leader. The combination of low valuation and strong performance metrics suggests that the stock is likely to gain attention on Wall Street.

In summary, Micron Technology is poised to lead the market by the end of 2026, riding the wave of increasing AI memory demands. With its focused strategy and solid financials, the company can expect continued growth in this critical sector. For more insights, visit Filmogaz.com.