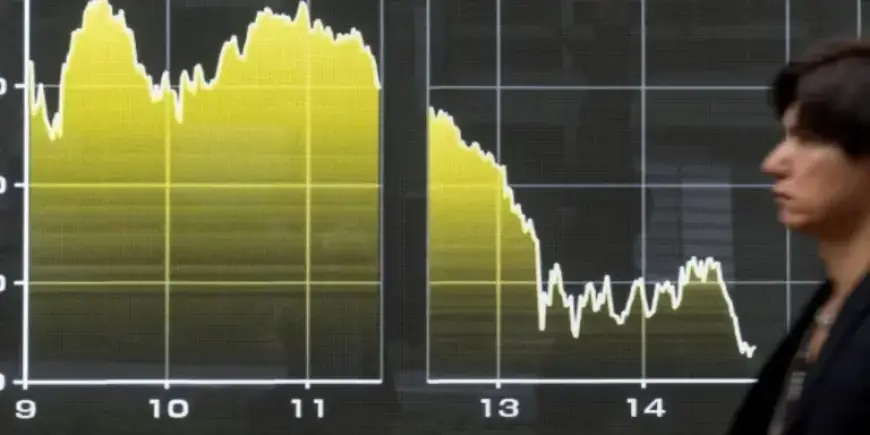

Yen Surge Boosts Japanese Bonds, Drives Stock Decline

Japanese markets experienced a notable shift on Monday, as the yen surged amid intervention signals from U.S. and Japanese authorities. This rebound in the yen positively impacted the country’s long-term government bonds but negatively affected stock prices.

Market Overview

The Nikkei Stock Average, a key benchmark for Japanese equities, closed down by 1.8%. The decline was primarily driven by significant losses among major exporters.

Key Contributors to Stock Market Decline

- Honda Motor: Fell by 4.4%

- Nissan Motor: Dropped by 4.2%

- Panasonic Holdings: Decreased by 4.7%

The performance of these firms illustrates the vulnerability of Japan’s export-driven economy to currency fluctuations. As the yen strengthened, concerns arose regarding the competitiveness of Japanese goods abroad.

Implications of Yen Surge

The recent support measures for the yen reflect ongoing challenges faced by the Japanese economy. The combination of a stronger currency and declining stock prices poses a complex scenario for investors.

As investors navigate these changes, the impact on both the bond and stock markets will be closely monitored, emphasizing the crucial relationship between currency valuation and economic health.