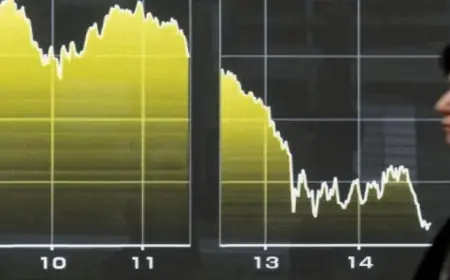

Japan Collaborates Closely with US Amid Rising Yen Intervention Risks

Japanese authorities are closely working with the United States regarding foreign exchange issues as the yen faces significant volatility. A recent surge in the yen’s value has raised concerns about coordinated currency interventions for the first time in 15 years.

Coordination Between Japan and the U.S.

Atsushi Mimura, Japan’s currency diplomat, confirmed that officials are in alignment with U.S. authorities. They are prepared to respond effectively based on a joint statement from September 2022. This agreement emphasizes the importance of market-driven exchange rates while allowing for intervention to address excessive volatility.

Key Developments in Currency Intervention

- Recent market activity has heightened awareness of potential U.S.-Japan currency intervention.

- Friday’s reported rate checks by the New York Federal Reserve contributed to a sudden increase in the yen’s value.

- Japanese Finance Minister Satsuki Katayama noted the government is monitoring the situation with urgency.

Both officials refrained from commenting on specific market interventions. Katayama stated, “I believe we are responding in line with the statement.” The potential for coordinated intervention remains uncertain.

Historical Context

U.S. involvement in foreign exchange interventions is rare. The last significant intervention took place in March 2011, following the devastating earthquake in Japan. These actions usually occur during times of extreme market volatility.

As the situation develops, both countries remain committed to maintaining economic stability and managing exchange rate fluctuations. Japan’s proactive stance highlights its determination to address risks associated with currency volatility.