Gabon Eurobonds: Markets Welcome Significant Sovereign Risk Decline

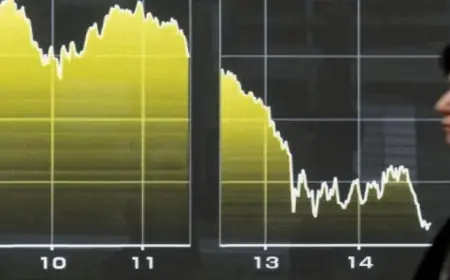

Gabon is signaling a positive shift to international financial markets, particularly regarding its eurobonds. Recent developments show a considerable improvement in the perception of Gabon’s sovereign risk among investors. The spread of Gabonese eurobonds, a crucial indicator of sovereign risk, has contracted by about 180 basis points in recent weeks.

Sovereign Risk Improvements in Gabon

This noticeable change in sovereign risk perception is significant and unusual for such a brief period. It highlights a renewed confidence in Gabon’s economic and institutional trajectory.

Stable Political and Economic Environment

The current dynamics occur within a more stable environment. Financial markets value the clarity of Gabon’s economic policies and the continuity of its public action. These elements play a vital role in assessing country risk. Investors appreciate the improved governance, highlighted by budgetary discipline and a clear commitment to restoring Gabon’s financial credibility.

Role of the International Monetary Fund

A key driver of this renewed confidence is the ongoing discussions around an economic program with the International Monetary Fund (IMF). This framework promises enhanced macroeconomic oversight, budgetary predictability, and structured reforms. Even in its preliminary stages, the resumption of dialogue with the IMF reassures investors about Gabon’s financial trajectory and its ability to meet medium-term obligations.

Currency Repatriation and Financial Discipline

- The Gabonese government has mandated the Gabon Oil Company (GOC) to repatriate all restoration funds in U.S. dollar accounts.

- This decision, effective January 21, 2026, aligns with CEMAC regulations on currency exchange for extractive industries.

- It aims to enhance financial transparency and improve currency reserves.

This initiative is part of Gabon’s strategy to better manage financial flows from natural resources and is expected to bolster the foreign exchange reserves of the Bank of Central African States (BEAC).

Improvements in Bond Performance

Gabonese eurobonds have recently performed better than in previous months, indicating a gradual reduction in the risk premium required by investors. This trend positions Gabon as one of the emerging market signatures that is currently attracting significant attention.

Looking Ahead

Despite the positive shift, analysts advise caution. While confidence is returning, it largely hinges on the effective implementation of announced reforms. The Gabonese government must strike a balance between fiscal discipline and social stability to maintain this momentum.

In a matter of months, Gabon has transformed a long-standing sentiment of distrust. Financial markets are beginning to regain faith in the nation’s prospects. The challenge now lies in sustaining this momentum to achieve long-term credibility.