2026 Freight Market Transforms with Federal Funding and CDL Enforcement

The freight market is poised for significant transformation as we approach 2026. The U.S. Department of Transportation (DOT) has made several announcements that highlight a future marked by increased regulation, infrastructure investment, and challenges in driver availability.

Federal Funding and CDL Enforcement

On December 30, 2025, the DOT announced over $118 million in grant funding through the Federal Motor Carrier Safety Administration (FMCSA). This funding is aimed at enhancing oversight, enforcement, and training for Commercial Driver’s Licenses (CDL). Transportation Secretary Sean P. Duffy emphasized the importance of keeping unqualified drivers off the roads, thus improving safety nationwide.

The implications of this initiative for shippers could be multifaceted. Stronger enforcement and better training will promote long-term safety. However, increased regulatory oversight may restrict driver availability, particularly in regions with existing compliance gaps. David Stone, a director of transportation at WSI, highlighted that maintaining compliance and safety is crucial for long-term capacity availability.

Scrutiny on State-Level CDL Programs

In addition to funding, the DOT plans to closely examine state-level CDL programs. Potential funding withdrawals for states that do not meet CDL issuance standards create uncertainty in the trucking industry. Public statements suggest that uneven implementation of CDL standards may lead to regional imbalances regarding driver availability.

Freight brokers will play a vital role in adapting to these changes. It is becoming increasingly difficult for shippers to manage regulatory shifts as they occur without external assistance.

Infrastructure Investment for Road Safety

Just prior to the CDL announcement, the DOT unveiled nearly $1 billion for roadway safety improvements through the Safe Streets and Roads for All (SS4A) program. This funding will support 521 projects spread across 48 states, Puerto Rico, and tribal communities. Designed to decrease serious injuries and fatalities, these initiatives include:

- Redesigns of intersections and roundabouts

- Improvements in pedestrian and cyclist safety

- Upgraded emergency communications

- Enhanced traffic incident management facilities

While such infrastructure upgrades promise long-term benefits, they may introduce temporary disruptions during construction, affecting transit times. Shippers must proactively route freight around these active projects to mitigate delays.

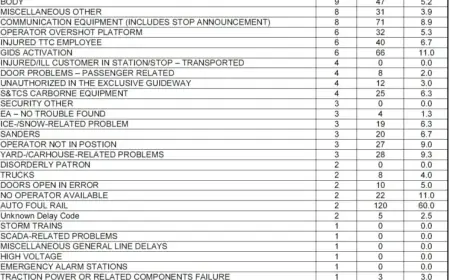

Capacity Challenges and Equipment Orders

The U.S. trucking market is currently experiencing a capacity crunch. Reports indicate that orders for tractors and trailers have declined significantly year over year. Key areas affected include:

- Class 8 sleeper tractors, vital for long-haul transportation

- Dry van trailers, essential for general freight

- Refrigerated trailers, crucial for food and pharmaceutical supplies

This decline in equipment orders signals a challenging landscape for fleet expansion and reduces the industry’s ability to respond to demand spikes. Increased carrier exits over the past two years have further tightened capacity, leading to a market with less buffer during peak times.

Cross-Border Freight as a Stabilizing Force

Despite domestic capacity challenges, cross-border freight between the U.S. and Mexico has emerged as a source of stability. Recent data shows a 15% increase in Mexican exports to the U.S., driven by ongoing manufacturing activities and strategic supply chain adjustments. However, this growth introduces complexities related to customs compliance and security.

The Role of Freight Brokerage in 2026

Given the shifting dynamics of regulatory policies and infrastructure investments, the role of freight brokers is evolving. Modern freight brokers must provide:

- Scenario-based capacity planning across different market conditions

- Access to verified, compliant carrier networks

- Alternate routing strategies during infrastructure improvements

- Real-time insights into regulatory and market changes

Stone emphasized that shippers relying on static forecasts or carrier strategies risk exposure in this rapidly changing market. Flexibility and real-time visibility will be vital for maintaining service levels.

Looking Ahead to 2026

Federal investments in safety and infrastructure reflect a long-term commitment to enhancing the transportation system. However, shippers must navigate a more regulated, simplified, and complex freight environment in the near term. As we approach 2026, shippers that build adaptable strategies with expert brokerage support will be best positioned for success in this evolving landscape.