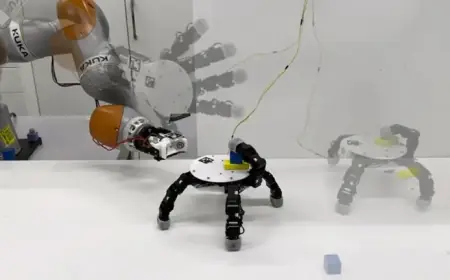

Terminator Technology Revolutionizes the Future of Robotics

The world of robotics is on the brink of a significant transformation, largely influenced by emerging technologies like artificial intelligence (AI). Innovations in AI are reshaping industries, including finance, by introducing advanced automation that can alter the roles traditionally occupied by professionals, such as loan officers.

AI Technology in the Mortgage Sector

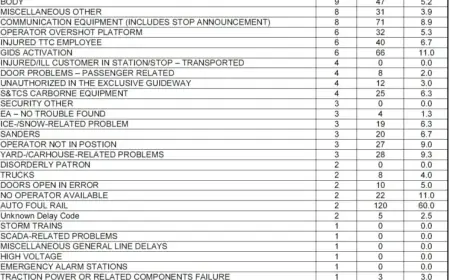

A recent study from MIT sheds light on this transition, indicating that AI could automate tasks representing about 11.7% of total U.S. wage value. This equates to approximately $1.2 trillion across an economy of 151 million workers. The findings suggest that many tasks associated with loan origination—such as document reading and data extraction—are highly automatable.

Rise of Automation

Organizations like Fairway Home Mortgage are already testing AI tools to enhance productivity. COO Len Krupinski emphasizes the benefits of “agentic sales assistants.” These AI-driven systems can handle multiple calls simultaneously, showcasing the capacity to multitask beyond human limitations.

- AI tools are redefining the job landscape in the mortgage industry.

- Agentic assistants demonstrate impressive results, often outperforming traditional cold callers.

- Many borrowers do not disengage due to the effectiveness of AI conversations.

Protecting Human Connections

Despite advancements in technology, Krupinski reassures that the emotional connection between borrowers and loan originators remains irreplaceable. “If you do a good job for a customer, no technology can replace that,” he asserts. This highlights the ongoing relevance of human touch in client relations, even as automation becomes more prevalent.

Consolidation and Future Opportunities

The mortgage industry is witnessing a wave of consolidation, which is opening up new avenues for innovation. Brian Gutierrez, a notable figure in the field, encourages independent brokers to leverage modern tools that don’t tether them to massive platforms. “To compete, you don’t need to join a giant platform,” Gutierrez states.

- Consolidation creates opportunities for new startups and disruptive technologies.

- Independent brokers can thrive by utilizing customized and advanced technological solutions.

The Importance of Customization

One of the critical advantages of using innovative platforms like Lendware is the ability to customize communications. Rather than sending standard template emails, brokers can craft personalized messages that resonate with their unique brand voice. This tailored approach is essential for maintaining a competitive edge in an increasingly automated landscape.

Conclusion

Ultimately, the evolving role of AI in the mortgage sector signifies a seismic shift. While automation presents challenges, it also offers opportunities for innovation and improved efficiency. As the industry adapts, the balance between technology and human interaction will be crucial for success.