HSBC Stock Nears 52-Week High Amid FTSE Drop on Trump Tariff Threat

HSBC shares are nearing a 52-week high, closing up 0.55% at 1,238.8 pence on January 19, 2026, in London. This marks a significant moment for the banking giant, as it approached its peak following a volatile market day.

Market Overview

On the same day, the FTSE 100 index fell by 0.4%, mainly due to renewed tariff threats from the U.S. These concerns have caused unrest in European markets, prompting many investors to seek safer asset options.

HSBC Performance

- Shares reached an intraday high of 1,240.0 pence.

- HSBC’s recent growth highlights its resilience amid a fluctuating market.

- The bank’s dividend yield is currently around 4%, attracting income-focused investors.

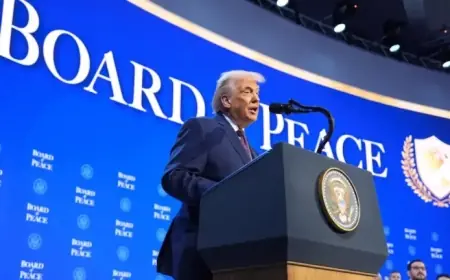

Impact of Tariff Threats

President Donald Trump’s potential tariff implementations have caused considerable market turbulence. Analysts suggest that while the threats may impact market psychology, actual enforcement might be less severe.

European Market Reactions

Following the Trump administration’s warnings, European stocks suffered their steepest declines in two months. Key sectors affected included luxury goods, automotive, and technology.

Analyst Insights

George Lagarias, chief economist at Forvis Mazars, indicated that the White House is likely to consistently use tariff threats. Meanwhile, Andrew Kenningham, chief European economist at Capital Economics, remains skeptical about the actual execution of these tariffs.

HSBC Regulatory Updates

HSBC recently disclosed that it holds a 6.13% voting stake in International Personal Finance Plc. This stake results from a cash-settled equity swap, pushing it past regulatory reporting requirements.

Upcoming Key Dates

- High Court hearing for Hang Seng Bank’s privatization: January 23

- Expected scheme implementation date: January 26

- Hang Seng Bank’s withdrawal from listings: January 27

Future Considerations

With potential tariff repercussions looming, concerns persist about slower growth in Europe, which could dampen loan demand and impact deal activities. Investors are advised to keep an eye on HSBC’s Annual Results for 2025, scheduled for February 25.