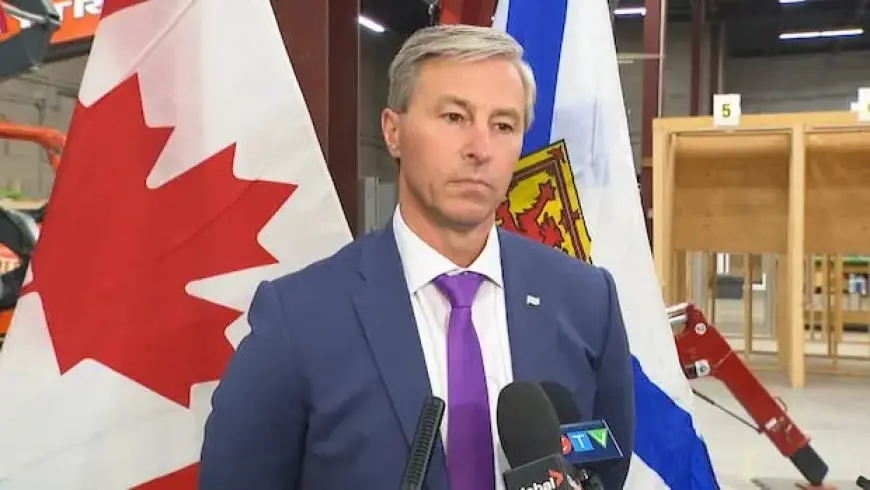

Houston Urges Reevaluation of N.S. Coal Plants Amid ‘Major Concerns’

Premier Tim Houston has raised important issues regarding the valuation of coal plants operated by Nova Scotia Power. He believes that this valuation is artificially inflated, potentially allowing the company to generate excessive profits. As of December 2025, the net book value of these plants stands at $700 million.

Concerns Over Coal Plant Valuation

Houston’s critique stems from the fact that Nova Scotia Power is seeking to recover this valuation through a process known as securitization. This involves issuing bonds supported by the revenue of the coal plants. However, Houston has expressed significant reservations about this measure, particularly about how the plants’ values are calculated.

Regulatory Backing and Timeline

The province’s energy board has been in discussions with Nova Scotia Power regarding securitization for several months. However, Houston recently opposed the financial strategy due to the timeline imposed by federal legislation, which mandates the retirement of coal plants within the next four years. He noted that when this timeline was established in the late 2010s, the operational lifespan of these plants was not reflected in the financial assessments.

Drawing on his background in accounting, Houston stated that high asset valuations could benefit the utility financially, while ratepayers suffer from inflated costs. He emphasized his commitment to collaborating with the Nova Scotia Energy Board, though he did not provide details on potential next steps.

Securitization as a Solution?

Officials from Nova Scotia Power mentioned that securitization could be a vital part of their application for new power rates. They claim it could help alleviate expected rate increases, with potential savings of up to $85 million for customers over a two-year span. This strategy, although novel in Canada, has seen use in various states across the U.S. for retiring coal facilities.

The utility acknowledges that securitization might mean forgoing up to $200 million in earnings from coal operations, yet they argue it would improve their financial standing and credit metrics. Currently, a public hearing regarding the rate application has concluded, and the proposal is under review by the energy board.

Rate Increases and Province’s Role

Houston has previously criticized the proposed rate increases associated with the application. According to the current plan, residential customers could see rates rise by 8.1 percent between 2026 and 2027. Despite this, there has been limited engagement from the provincial government in the rate-setting discussions before the energy board. The province is expected to submit a final statement by the end of the month.

- Coal Plant Retirement Deadline: 2025

- Current Net Book Value: $700 million

- Projected Savings for Customers: Up to $85 million

- Potential Earnings Forgone: Up to $200 million

- Proposed Rate Increase: 8.1% between 2026 and 2027

As discussions continue, the implications of these valuations and proposed financial strategies will impact both Nova Scotia Power and its customers significantly.