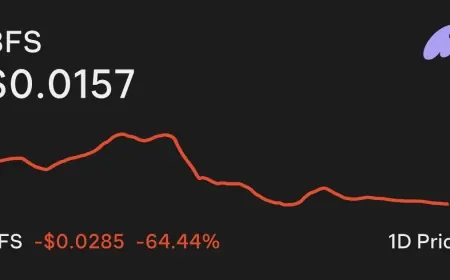

UK Inflation Rate Ticks Up to 3.4% as Airfares and Tobacco Push “Latest Inflation” Higher Ahead of Bank of England Decisions

The latest UK inflation data released Wednesday (January 21, 2026) show the inflation rate rising to 3.4% in the year to December 2025, up from 3.2% in November. It’s the first clear uptick in several months and a reminder that the path back to stable, low inflation can be bumpy even when the bigger trend has cooled from the highs of recent years.

For households, the headline number matters less than what’s underneath it: prices linked to seasonal travel, duties, and everyday food items were key drivers. For policymakers, the more important signal is that services inflation remains elevated, keeping pressure on the Bank of England to move cautiously on interest-rate cuts.

Latest Inflation Breakdown: CPI, CPIH, Core, and Services

Here’s how the main measures look for December 2025:

-

UK inflation rate (CPI): 3.4% year-on-year (up from 3.2% in November)

-

CPI including housing-related costs (CPIH): 3.6% year-on-year (up from 3.5%)

-

Monthly change: CPI and CPIH both rose 0.4% in December

-

Core inflation (excluding energy, food, alcohol, tobacco): 3.2% (broadly steady)

-

Services inflation: 4.5% (slightly higher, still sticky)

-

Food and non-alcoholic beverages: 4.5% year-on-year (up from 4.2%)

The headline rise does not automatically mean inflation is “re-accelerating,” but it does show that pockets of price pressure are still active—especially in categories that can swing sharply around holidays and tax changes.

What Drove UK Inflation Higher in December

Three themes stand out in the December mix:

-

Seasonal airfares

Holiday travel pricing can lift the transport component quickly, and that effect often shows up as a one-month bump that fades when seasonal patterns reverse. -

Tobacco duty effects

Duty changes tend to pass through rapidly to shelf prices, meaning they can nudge the headline rate even if underlying demand conditions are soft. -

Food prices, especially staples

Food inflation moving higher again is notable because it hits lower- and middle-income budgets first. Even when the overall inflation rate slows, persistent food price gains keep the cost-of-living pressure feeling “unfinished.”

Why Services Inflation Is the Number Markets Watch Most

Services inflation (now 4.5%) matters because it is closely tied to domestic costs: wages, rents, and business overheads. When services inflation stays high, central bankers worry that price growth is becoming entrenched at home rather than imported through global energy and goods markets.

Core inflation holding around 3.2% suggests underlying pressures aren’t surging, but services staying well above the 2% target zone keeps the “all-clear” signal from flashing.

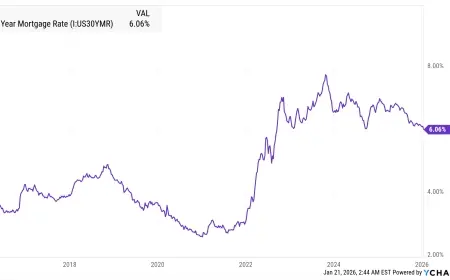

What This Means for the Bank of England and Interest Rates

With the inflation rate now at 3.4% and services inflation still elevated, the Bank of England has an incentive to avoid moving too quickly. The current debate is less about whether rates will eventually fall and more about timing: policymakers want clearer evidence that services inflation and wage growth are cooling consistently.

This latest inflation print makes an immediate, aggressive pivot toward rate cuts less likely, but it doesn’t rule out gradual easing later in 2026 if energy effects fade and domestic price pressures continue to soften.

What to Watch Next: The January–March Inflation Path

The next few releases will matter disproportionately because they shape expectations for the spring:

-

Energy and household bills: declines (or smaller increases) can pull headline inflation down quickly through base effects.

-

Food inflation trend: if food stays firm, public pressure on living costs remains intense even if headline CPI edges lower.

-

Services and wage momentum: sustained cooling here is the clearest route toward a smoother return to target.

-

Consumer demand: weaker spending can reduce pricing power, but it also raises recession and jobs risks—another balancing act for policymakers.

“UK Inflation” Right Now

The latest inflation reading puts the UK inflation rate at 3.4%, a step up that looks driven more by specific categories—holiday travel, duty-linked items, and food—than by a broad re-heating of the economy. Still, with services inflation at 4.5%, the Bank of England is likely to keep a careful stance: inflation is lower than it was, but not yet comfortably “done.”

If you want, tell me your focus (household bills, mortgage rates, wages, or food prices) and I’ll tailor a quick, practical “what it means for you” version around the latest inflation numbers.