California and L.A. Propose Taxes on Ultra-Rich to Combat Rising Costs

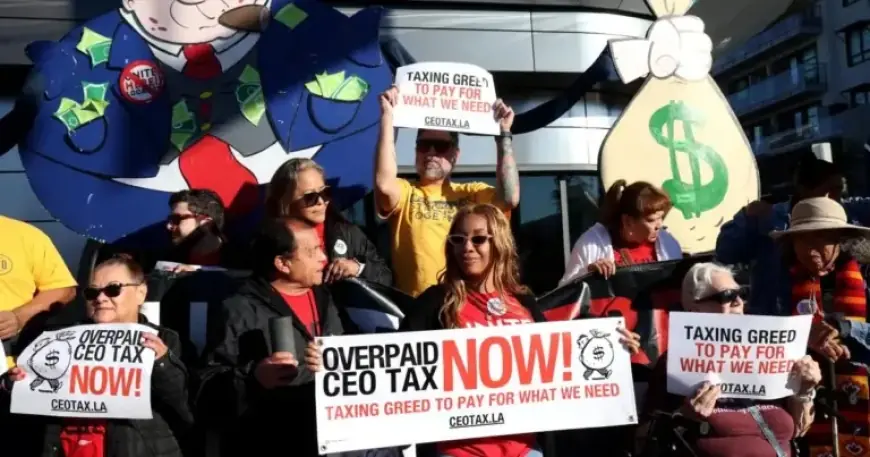

California is reconsidering its approach to taxation as a response to rising living costs. Recently, activists proposed tax increases on companies with highly paid executives in Los Angeles. This rally took place outside the Tesla Diner, notably owned by Elon Musk, the richest man globally.

Proposals Targeting Billionaires

In light of California’s severe affordability crisis, proposals to tax the ultra-rich are gaining traction. The state boasts over 200 billionaires, with their collective wealth rising dramatically from $300 billion in 2011 to $2.2 trillion by October 2025. These proposals aim to use tax revenue for essential public services like healthcare.

Billionaire Tax Proposal

- The proposed billionaire tax targets taxpayers and trusts with assets exceeding $1 billion.

- It suggests a one-time tax of up to 5%, with payments extendable over five years.

- Supporters aim to collect nearly 875,000 signatures to place this initiative on the November ballot before June 24.

The main backer, the Service Employees International Union-United Healthcare Workers West, estimates the tax could generate $100 billion. Most of the funds would support healthcare programs, while a smaller portion would assist education and food programs.

Public Reaction and Concerns

However, the proposals have faced backlash from some of California’s wealthiest individuals. Concerns are being raised about the potential for billionaires to relocate, taking their businesses and tax revenue with them. California Governor Gavin Newsom cautioned against isolating the state from national competition, emphasizing the need for a pragmatic approach.

Individuals like Andy Fang, co-founder of DoorDash, and Peter Thiel, co-founder of PayPal, have expressed intentions to leave California, citing such taxation proposals as detrimental. Others, including famous billionaires like Larry Page and Sergey Brin, are reportedly shifting their business interests away from the state.

Impact on Local Economy

In Los Angeles, the “Overpaid CEO Tax” is also being explored. This measure aims to raise taxes on companies where CEOs earn at least 50 times more than their median employees. This initiative requires 140,000 signatures to qualify for the ballot within 120 days.

- Seventy percent of the tax revenue would fund housing for working families.

- Twenty percent would be allocated for street and sidewalk repairs.

- Five percent would assist after-school programs and access to fresh food.

Supporters argue that this initiative targets the disparity in wealth distribution, while critics express fears that high tax rates may drive companies away from the city, exacerbating existing economic challenges.

Conclusion

The ongoing discussions around these taxation proposals reflect California’s urgent need to address its affordability crisis. As the state navigates this complex issue, the outcomes could have significant implications for its economy and the future of its wealthiest residents.