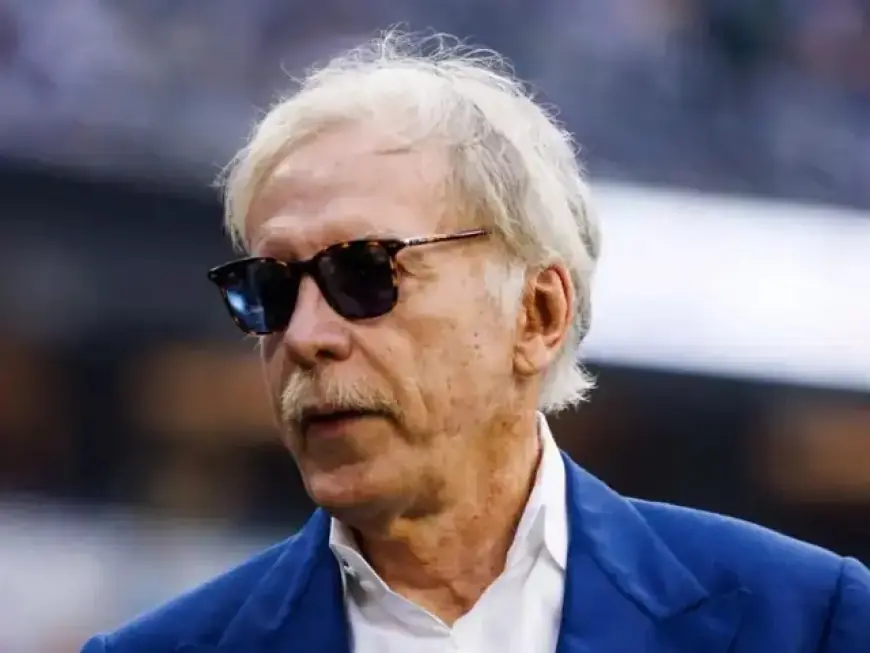

Stan Kroenke becomes America’s largest private landowner after massive New Mexico deal

Stan Kroenke has vaulted to the top of the U.S. private landowner rankings after acquiring a sprawling ranch property in New Mexico that spans roughly 937,000 acres, pushing his total holdings to about 2.7 million acres across the American West and Canada. The purchase reshapes the conversation around land, wealth and influence—especially for a figure already best known for building a multi-club sports empire.

How Stan Kroenke reached the No. 1 spot

The New Mexico acquisition caps years of steady expansion through ranch and agricultural purchases. By surpassing the 2.5-million-acre threshold, Kroenke moves ahead of other high-profile buyers and consolidates a portfolio that now stretches across multiple states and provinces. To grasp the scale, 2.7 million acres is more than double the land area of Delaware. It’s not one contiguous block; rather, it’s a network of working ranches, grazing lands, and open country that function as long-term, tangible assets.

What’s in Kroenke’s land portfolio

-

Southwest & Rocky Mountain West: Extensive ranchlands suited for cattle operations and wildlife habitat, with water rights and grazing allotments that underpin long-term value.

-

Northern ranges and Canadian holdings: Large tracts that pair livestock capacity with conservation and carbon-value potential.

-

Infrastructure and operations: These properties typically include headquarters compounds, fencing, stock water systems, and seasonal housing—assets that, when professionally managed, can generate income while appreciating over time.

While the latest purchase draws headlines for its sheer size, the broader strategy appears consistent: accumulate large-scale, operational ranch properties with durable cash-flow characteristics, optionality for conservation easements, and inflation-resistant land value.

Why Stan Kroenke is buying land now

Portfolio diversification

Kroenke’s move aligns with a wider shift among ultra-high-net-worth investors toward hard assets with low correlation to public markets. Working lands can provide tax efficiency, cash yield, and resilience against volatility.

Water, conservation, and optionality

Rangeland with dependable water access and intact ecosystems carries premium value. Beyond ranch operations, owners can explore conservation partnerships, habitat credits, and carbon-related programs—avenues that can monetize stewardship while preserving landscapes.

Intergenerational planning

Large, well-run ranches are intergenerational stores of value. They can be professionally managed, passed down, and reconfigured without the headline risk that often accompanies splashier commercial deals.

The Stan Kroenke effect on sports, real estate, and regional economies

Kroenke’s portfolio now spans major professional teams, arena and stadium assets, and vast rural holdings—a rare combination that bridges urban entertainment districts and remote ranchlands. The common thread is long-horizon capital: venues generate recurring revenue and anchor development; landbanks offer stability and upside. Together, they provide flexibility during economic cycles.

For communities, the impact will hinge on management choices:

-

Ranch operations and employment: Continued investment in fencing, water systems, and range improvement typically supports local jobs and service businesses.

-

Access and conservation: Decisions around easements, hunting leases, and habitat projects can influence public access and wildlife outcomes.

-

Tax base and services: Large private holdings shape county finances; collaborative approaches with local governments can align land use with infrastructure needs.

What experts are watching next

-

Operational footprint: Whether the New Mexico property is integrated into existing ranch management or run as a semi-autonomous unit with unique conservation objectives.

-

Water strategy: How groundwater and surface-water rights are prioritized, improved, or traded within the wider portfolio.

-

Conservation partnerships: Potential easements or habitat-restoration projects that lock in ecological value while delivering tax and community benefits.

-

Rural-urban leverage: Whether venue-led development in cities and land conservation in rural areas become a signature two-pronged model for large private owners.

-

Market ripple effects: Big transactions can lift values regionally, influencing neighboring ranch sales, financing terms, and estate planning for multigenerational land families.

Why this matters beyond Stan Kroenke

The ascent of America’s largest private landowner underscores a broader trend: the quiet consolidation of rangeland and farmland by a small circle of buyers. That consolidation raises questions about stewardship, rural vitality, and the future of open spaces. Yet it also highlights avenues for public-private cooperation—from wildlife corridors to wildfire resilience—when long-term owners commit capital and align incentives with local stakeholders.

With the New Mexico purchase, Stan Kroenke has transformed his reputation from sports magnate to land baron at national scale. The move is more than a headline; it’s a strategic bet on land as the ultimate long-duration asset—tangible, scarce, and, when managed well, both productive and resilient. Expect closer scrutiny of how this new No. 1 deploys resources on the ground, and how his decisions ripple from rural counties to boardrooms and arenas far beyond the ranch gate.