Taxpayers Endure Delays as CRA Resolves Errors and Processes Refunds

As the 2025 tax season draws near, many Canadians are feeling the strain of unresolved tax issues with the Canada Revenue Agency (CRA). A significant number of taxpayers are experiencing frustrating delays as they wait for the CRA to correct errors and process refunds. These burdens stem from issues like incorrect assessments and delayed applications for waiving penalties.

Ongoing Tax Disputes and Delays

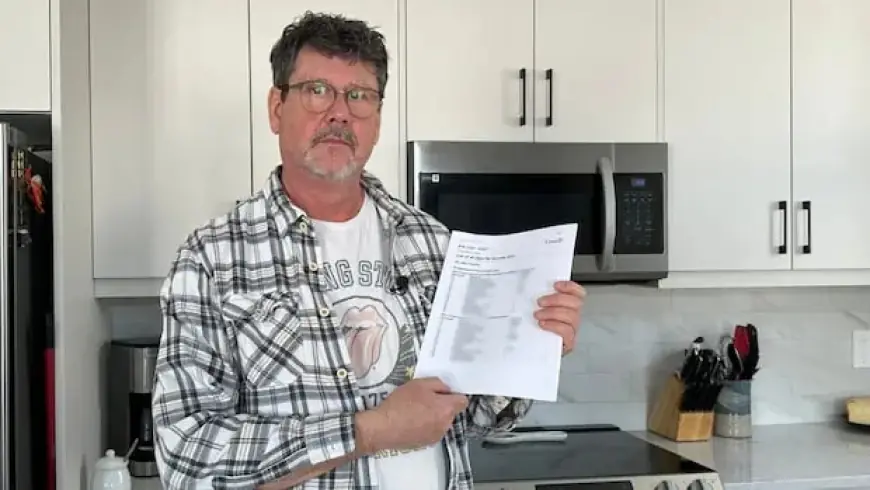

Bill Bisson from Beaver Bank, Nova Scotia, has been waiting for ten months to resolve a penalty of $3,471 related to his 2023 tax return. He believes the penalty is a result of a CRA error that incorrectly doubled an income slip. “It’s stressful; it just keeps hanging over my head,” Bisson stated, highlighting the emotional toll such delays can cause.

The CRA has acknowledged potential processing delays that may extend up to 12 months for various services, including disputes over penalties and cases involving the disability tax credit. Bisson’s case exemplifies the distress many are facing, with his penalty amount increasing to $3,836 due to accumulating interest.

Impacts on Taxpayers

- Long waits for resolution causing stress for taxpayers.

- Legal representatives report clients emotionally affected by unresolved issues.

- Growing penalties increase financial strain.

Tax Refund Backlog and Discrimination Against Vulnerable Groups

Helena Ferreira, a financial adviser from Hamilton, notes that many of her clients are facing similar dilemmas. She recounted two cases where clients’ income slips were mistakenly doubled, leading to resolution times of 18 months or longer. Such issues leave taxpayers questioning the agency’s accountability in processing claims.

The current environment has left many taxpayers feeling helpless. Christine Giles of Halifax recounted her struggles: after winning a battle to secure a disability tax credit for her daughter, she now awaits a possible $15,000 refund. “If I owed money to the CRA, I’d face penalties, but I must wait for them to process my refund,” she lamented.

CRA’s Response and Staffing Issues

The CRA attributes these delays to increased demand due to a rising population and new tax initiatives. Furthermore, complications arose after workforce reductions that decreased agency capabilities. According to the Union of Taxation Employees, over 11,000 positions were cut since March 2024.

In reaction to the ongoing backlog, the CRA has initiated a process to rehire workers while implementing additional measures to streamline operations. Yet, doubts remain among labor representatives regarding the sustainability of these staffing changes.

Calls for Improvement

Canada’s Taxpayers’ Ombudsperson, François Boileau, has emphasized the need for the CRA to prioritize tax adjustments, particularly for vulnerable groups relying on critical tax credits. Many taxpayers have shared stories of unsuccessful attempts to contact CRA representatives, further illustrating the operational challenges faced by the agency.

Despite efforts to address these issues, ongoing budget cuts and uncertainty about job stability at the CRA have left many concerned about the future of tax services. As Canadians approach the 2025 tax season, the stress surrounding unresolved tax returns and penalties continues to grow.