California’s ‘Jock Tax’ Costs Super Bowl LX Players Thousands in Income

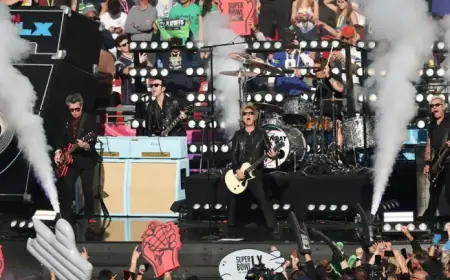

The upcoming Super Bowl LX is set to take place on February 8 at Levi’s Stadium in Santa Clara, California. This high-profile event poses significant financial implications for the participating players, particularly concerning California’s “jock tax.” This state tax system assesses professional athletes based on the number of days they spend performing within the state, impacting their overall earnings.

Understanding California’s ‘Jock Tax’

In California, the jock tax applies not only during regular NFL season games but also extends to the Super Bowl. Athletes from both the winning and losing teams will face this tax burden, which reduces their income after bonuses.

Bonus Structure and Take-Home Pay

Players participating in Super Bowl LX will receive substantial bonuses as per NFL regulations:

- Winning Team: $178,000

- Losing Team: $103,000

However, after accounting for taxes, the net income players actually retain is significantly lower. Research fellow Jeffrey Degner from the American Institute for Economic Research notes that:

- Winning Team’s Take-Home Pay: Approximately $86,000

- Losing Team’s Take-Home Pay: Roughly $49,800

The Complexity of Athlete Taxation

California’s jock tax affects the NFL players throughout the season. Jock taxes can be imposed by both states and municipalities, though they are more common at the state level. The “duty day” standard is used to calculate these taxes and considers:

- Game days

- Practice days

- Travel days

- Media obligations

This system multiplies an athlete’s total earnings by the ratio of their duty days in California to their total duty days. Every day spent in California, including media-related obligations, counts toward this tax liability. As stated by Degner, this leads to a complicated tax situation for players. They often have to file taxes in multiple states, from three to ten or more, based on their engagements.

Advice for Young Players

Given the complexities of tax obligations, it becomes crucial for teams to provide young players with access to experienced financial and tax advisors. This ensures that they navigate their earnings wisely and do not face financial pitfalls.

Super Bowl LX will not only be a showcase of athleticism but also a case study in the impact of taxation on professional sports professionals in California.