Shareholders Discontent with Major Oil-and-Gas Merger

Devon Energy has announced its acquisition of Coterra Energy, creating a substantial player in the U.S. shale industry. However, the response from shareholders has been mixed, particularly from those of Coterra.

Details of the Merger

The all-stock deal suggests a combined enterprise value of approximately $58 billion. Each company’s shareholders will have different stakes in the new entity. Specifically, Devon shareholders will control 54% of the merged company, while Coterra shareholders will hold 46%.

Market Reaction and Shareholder Sentiment

Following the announcement, Coterra’s stock experienced a decline, trading below the implied purchase price. This drop reflects concerns among shareholders about the merger’s financial implications.

Strategic Objectives

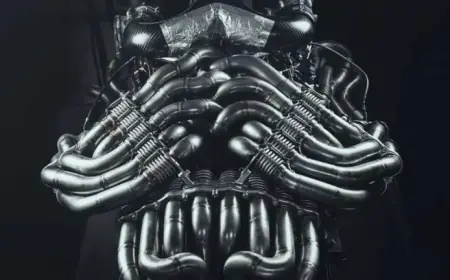

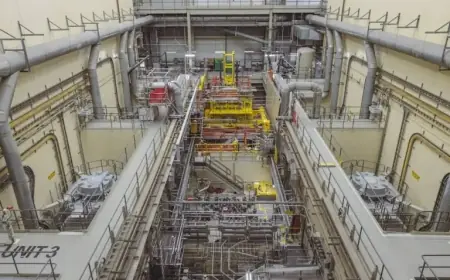

The merger aims to enhance the competitiveness of the newly formed corporation against larger rivals in the oil and gas sector. By merging, Devon and Coterra seek to achieve necessary economies of scale and increase operational efficiency.

Key Facts at a Glance

- Merger Announcement Date: February 2, 2026

- Combined Enterprise Value: $58 billion

- Shareholder Ownership:

- Devon Energy: 54%

- Coterra Energy: 46%

- Stock Reaction: Coterra shares fell post-announcement

The upcoming merger reflects the ongoing trend in the oil and gas industry, as companies seek to consolidate to enhance their market positions. Stakeholders will be keenly observing how this deal unfolds in the competitive landscape of energy production in the United States.