Ottawa Seeks Banks’ and Pension Funds’ Help for Affordable Housing: Minister

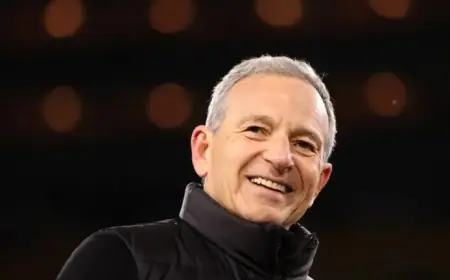

The Canadian federal government is actively seeking the involvement of banks and pension funds to enhance the pace of affordable housing construction. Housing Minister Gregor Robertson aims to mobilize developers and improve the availability of low-cost housing options for Canadians. This initiative is part of the newly established Build Canada Homes agency, which commenced operations in September 2025.

Build Canada Homes and Its Mission

Build Canada Homes has been allocated an initial funding of $13 billion. The agency is tasked with increasing the supply of non-market housing, which typically receives government support to offer rental units below market rates. Robertson emphasized his dedication to improving affordability by targeting the most vulnerable populations in the housing market.

Key Projects and Developments

- The agency announced the Arbo development in Toronto, featuring 540 units with at least 40% designated as affordable housing.

- Efforts to stimulate housing construction also include funding directly to municipalities for zoning changes.

Notably, housing starts in Canada increased by 5.6% in 2025, driven significantly by activity in Alberta and Quebec. However, Ontario and British Columbia experienced declines in construction. Robertson recognizes the mixed performance across provinces while affirming the necessity for private sector leadership in meeting housing targets.

Challenges Ahead

The pace of private construction depends heavily on fluctuating market conditions, including interest rates and demand from homebuyers. Robertson stated that Ottawa’s strategy involves attracting investment from various sources into affordable housing to mitigate market slowdowns.

Mike Moffatt, a housing policy expert, expressed concerns regarding the timing of government interventions. He warned that if projects are not initiated promptly, opportunities to enhance affordable housing could be missed. Furthermore, there is a political risk if construction rates drop during periods of high demand.

Attracting Investment from Financial Institutions

Robertson aims to reduce the perceived risks for banks and pension funds investing in affordable housing. He stressed the potential for a stable return on investment with a collaborative approach from federal and provincial governments.

- 450 applications have been received by Build Canada Homes from various proponents, including provinces and private developers.

- Robertson hopes to leverage the expertise of Ana Bailao, CEO of Build Canada Homes, in attracting new capital to the sector.

Despite the challenges, Robertson remains optimistic about involving financial institutions in affordable housing projects. Yet, Moffatt questions the feasibility of encouraging banks and pension funds to invest significantly in non-profit housing, as profitability often remains a primary concern for these entities.

As the initiative develops, stakeholders await to see how effectively Ottawa can align its goals with the financial interests of major capital sources, making affordable housing a viable option for all Canadians.