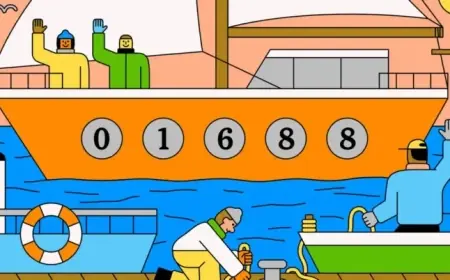

Visa Launches 5th Africa Fintech Accelerator, Highlighting Cross-Border Payments and AI Innovation

Visa has launched the fifth cohort of its Africa Fintech Accelerator program, focusing on innovation in cross-border payments and artificial intelligence (AI). This significant initiative includes 18 startups from 28 African markets, reflecting a transformative shift in the continent’s financial technology landscape.

Significance of the New Cohort

The participation of startups from countries like Burkina Faso and Djibouti illustrates a notable expansion in Africa’s fintech ecosystem. Traditionally dominated by a few leading nations, the industry is now embracing emerging markets. This shift suggests a broader acceptance of financial technology across various socio-economic environments.

Key Focus Areas and Trends

- Cross-Border Payments: Startups are developing innovative solutions aimed at enhancing the efficiency and speed of money transfers. Many are utilizing stablecoin infrastructures to achieve this goal.

- Artificial Intelligence: AI is increasingly applied in areas like risk assessment, fraud prevention, and credit scoring. This is especially beneficial for regions with limited access to traditional financial data.

Impact on Stakeholders

| Stakeholder | Before Visa’s 5th Cohort | After Visa’s 5th Cohort |

|---|---|---|

| Startups | Limited access to mentorship and funding | Increased support through Visa’s network and technology guidance |

| Investors | Focus on traditional markets with lower returns | Diversified investment opportunities in emerging markets |

| Consumers | Restricted access to modern financial solutions | Improved access to financial services, enhancing economic engagement |

Global Implications

The advancements stemming from this cohort are expected to impact markets beyond Africa. Countries such as the US, UK, Canada, and Australia are feeling consumer demands for efficient and borderless financial solutions. This could prompt similar initiatives among established institutions in these regions, aiming to foster technology-driven financial inclusivity.

Future Outlook

Looking ahead, several trends are likely to emerge:

- Increased Partnerships: There will likely be more collaborations between established financial institutions and fintech startups.

- Regulatory Adjustments: Authorities may revise their regulations to accommodate innovations like stablecoins and AI technologies.

- Consumer Adoption: The increased availability of financial solutions should result in greater adoption of mobile banking and digital payments across the continent.

In conclusion, Visa’s fifth Africa Fintech Accelerator cohort showcases the growing diversity in Africa’s fintech landscape. This strategic move holds the potential to redefine financial inclusion, paving the way for a more robust digital financial future in Africa.