Maine Cracks Down on Bitcoin ATM Scams Costing Victims Millions

Bitcoin ATM scams are rapidly becoming a significant threat, costing victims in the United States hundreds of millions annually. Maine has taken a pioneering step to combat these digital frauds by implementing regulations targeting cryptocurrency kiosks. This initiative aims to disrupt the operational tactics of scammers that rely on these ATMs.

Maine’s Fight Against Bitcoin ATM Scams

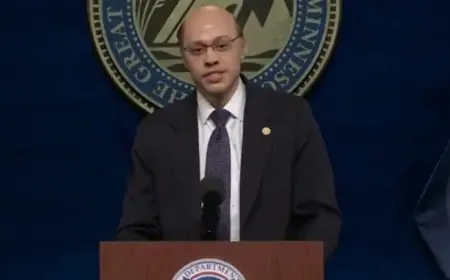

In a groundbreaking move, Maine has become the first state in the country to adopt comprehensive rules aimed at cryptocurrency kiosks. These regulations were introduced through the Money Transmission Modernization Act, which includes a unique provision called the “unhosted wallets” rule. This rule mandates that cryptocurrency companies must verify that a digital wallet receiving funds belongs to the actual customer.

Understanding the Scam

The modus operandi of Bitcoin ATM scams often involves a phone call from someone posing as a bank representative. These impersonators create a sense of urgency, convincing victims to withdraw cash and convert it into cryptocurrency. This process can unfold over several hours.

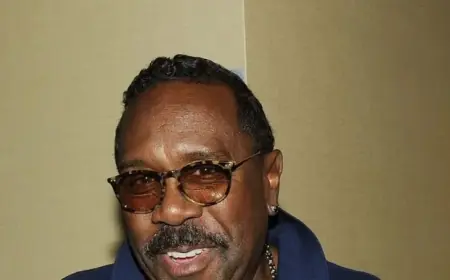

For instance, a victim named Mike Drake was deceived into withdrawing over $20,000 to feed into a Bitcoin Depot ATM. The scammers directed him through every step, complicating his ability to recognize the fraud.

Statistics on Bitcoin ATM Scams

- Reported losses from Bitcoin ATM scams surged from approximately $12 million in 2020 to over $333 million by November last year.

- Maine regulators believe the true figures could be significantly higher.

- Thousands of residents in Maine have fallen victim to these scams.

New Consumer Protection Measures

Maine’s legislative efforts also include specific provisions that further regulate cryptocurrency kiosks. Key aspects of these laws include:

- Transaction Limits: Customers cannot deposit or withdraw more than $1,000 in one day.

- Fee Regulations: Kiosk operators can charge a maximum fee of $5 or 3% of the transaction amount.

- Licensing Requirements: All kiosk operators must be licensed as money transmitters.

- Refund Policy: Operators are obligated to refund victims of fraud fully within a 90-day period if reported appropriately.

These measures aim to protect consumers and create accountability among kiosk operators. However, some companies have chosen to withdraw their services in Maine to avoid compliance with the new regulations.

Victims’ Stories and the Road Ahead

Bitcoin Depot, a significant player in the cryptocurrency ATM sector, recently settled for nearly $2 million to refund affected consumers. For victims like Mike Drake, sharing their experiences is crucial in preventing others from falling prey to these scams.

Individuals looking to file claims for refunds must do so through the Bureau of Consumer Credit Protection’s website, with a deadline set for April 1, 2026. Refunds are expected to begin in May 2026, depending on the volume of verified claims.

How to Guard Against Scams

Officials at both state and federal levels advise consumers to remain vigilant against potential scams. Here are essential tips to protect yourself:

- Be Aware of Urgency: Scammers often create a false sense of immediacy.

- Verify Requests: Always consult trusted sources before following instructions to use a cryptocurrency ATM.

- Reach Out for Support: Talk to someone you trust if you feel pressured or unsafe.

- Report Suspicious Activity: Notify law enforcement or relevant authorities if you suspect a scam.

By following these guidelines, individuals can help safeguard themselves from the rising threat of Bitcoin ATM scams. Maine’s proactive stance serves as a crucial step in the ongoing battle against cryptocurrency fraud.