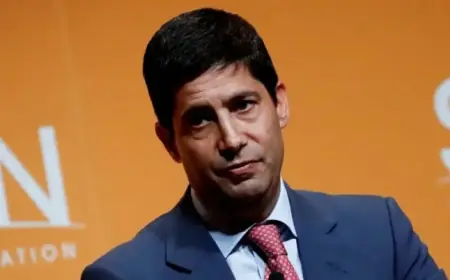

Kevin Warsh: Key Insights on Trump’s Federal Reserve Chair Pick

On January 30, 2026, President Donald Trump nominated Kevin Warsh as the next chair of the Federal Reserve. If Congress confirms him, Warsh will take over leadership of the central bank during a crucial period. Current Fed Chair Jerome Powell has faced criticism from the Trump administration for resisting calls to lower interest rates. Powell’s term will conclude in mid-May, leaving Warsh to manage an economy that is improving but remains unpredictable.

Key Insights on Trump’s Federal Reserve Chair Pick: Kevin Warsh

- Extensive Experience: Kevin Warsh has a robust background in monetary policy. He earned degrees from Stanford University and Harvard Law School.

- Government Roles: Warsh served as a special assistant for economic policy under President George W. Bush. He was also a Federal Reserve Board member from 2006 to 2011.

- Financial Sector Ties: His career includes roles at Morgan Stanley and Duquesne Family Office, managing investments for prominent financiers.

Monetary Policy Perspectives

A significant concern regarding Warsh’s nomination is his stance on monetary policy. Traditionally considered hawkish, he favors tighter financial controls to curb inflation, even if it slows economic growth. During his earlier tenure at the Fed, he expressed skepticism about expansive measures like quantitative easing, which inflated the Fed’s balance sheet to nearly $9 trillion.

In recent discussions, he has aligned more closely with Trump’s views, advocating for lower interest rates and suggesting a new Treasury-Fed Accord. This reflects a shift in his stance, hinting at potential changes in monetary policy under his leadership.

Impact on Federal Reserve Independence

Warsh’s nomination raises questions about the independence of the Federal Reserve. This autonomy is vital for making decisions free from political pressure concerning interest rates and financial stability. A fully independent Fed can resist short-term political motivations and focus on long-term economic health.

However, the Trump administration’s desire for lower interest rates complicates this independence. Critics of Warsh argue that he may be more susceptible to political influence than preceding chairpersons like Powell. His nomination poses challenges to the balance between political interests and economic principles.

What Lies Ahead

As Warsh steps into his potential new role, the financial community will closely monitor his decisions. The broader implications of his leadership could define the ongoing relationship between economic policy and the executive branch. Only time will reveal how Warsh’s approach will shape the Federal Reserve’s objectives and its response to future economic challenges.