Imperial Accelerates Shutdown of N.W.T. Oilfield Amid Challenging News

Imperial Oil Ltd. has expedited the shutdown of its Norman Wells oilfield, originally tapped over a century ago. The Calgary-based firm, which is primarily owned by ExxonMobil Corp., announced its decision to cease production by the end of Q3 2025. This update came during a recent conference call about the company’s financial performance.

Financial Impact of the Shutdown

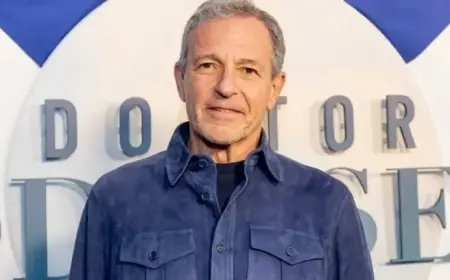

CEO John Whelan revealed that this change in plans resulted in a significant $320 million after-tax charge for the company’s fourth-quarter earnings. These earnings have dropped markedly compared to the previous year, influenced by various factors, including lower commodity prices and adverse weather conditions affecting production.

Key Financial Figures

- Fourth-quarter earnings: $492 million (down from $1.23 billion)

- Earnings per diluted share: $1.00 (compared to $2.37 a year ago)

- Revenue: $11.28 billion (down from $12.61 billion)

Despite the challenges, Imperial has increased its quarterly dividend by 20%, raising it to 87 cents per share.

Background on Norman Wells

Norman Wells, located nearly 700 kilometers northwest of Yellowknife along the Mackenzie River, has a population of about 800 residents. The town holds historical significance as the first community in the Northwest Territories established due to non-renewable resource development, dating back to its first oil discoveries in 1919.

Whelan expressed gratitude towards the Imperial team and highlighted ongoing commitments to local partnerships while focusing on the decommissioning process.

Government Response

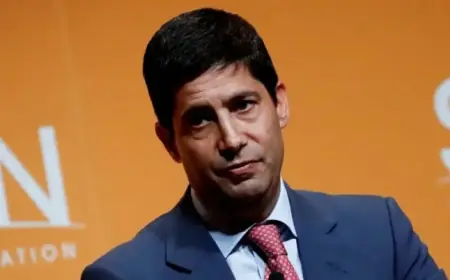

N.W.T. Premier R.J. Simpson called the news a “difficult” situation for those living in Norman Wells and the Sahtu region. He emphasized the community’s proud history and the importance of stability during this transition.

Production Statistics

Imperial’s upstream production has seen a decline, averaging 444,000 gross oil-equivalent barrels per day during the recent quarter, down from 460,000 a year earlier. Contributing factors also include an exceptionally wet fall that impeded operations.

| Metric | Q4 2024 | Q4 2025 |

|---|---|---|

| Gross Bitumen Production (Kearl Mine) | 299,000 barrels/day | 274,000 barrels/day |

| Average Price of West Texas Intermediate | US$59.14/barrel | US$49.00/barrel |

The recent decisions and developments mark significant changes in Imperial’s operational strategy and highlight broader challenges faced by the energy sector in the region.