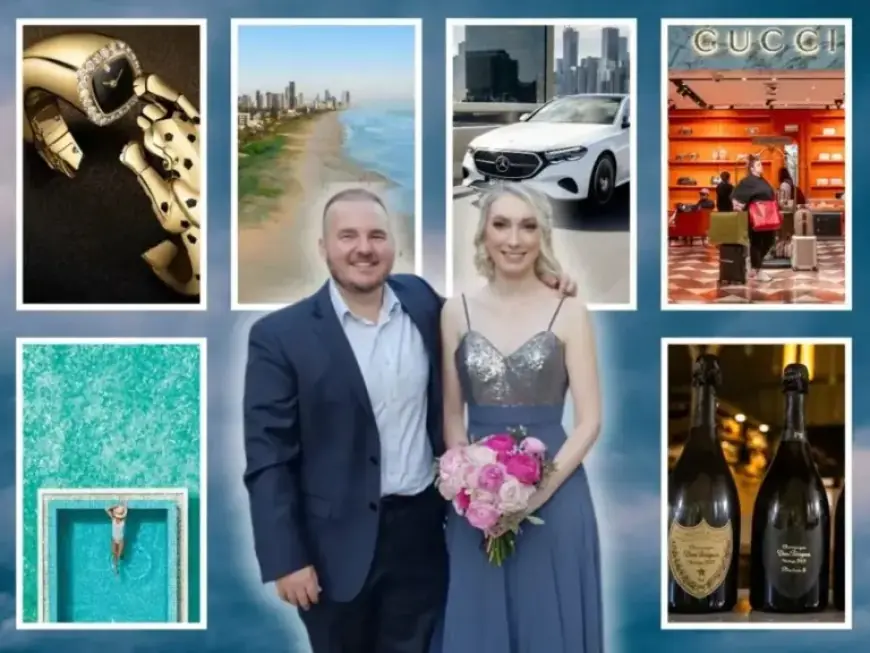

Alleged $76M Tax Fraud Funds Couple’s Lavish Lifestyle

A couple in Australia faces serious legal trouble after being accused of a $76 million tax fraud scheme. This alleged fraud is said to have financed a lavish lifestyle, raising significant concerns among authorities.

Details of the Allegations

Authorities claim that the couple exploited tax laws to secure millions. The charges target their extravagant expenditures, which included luxury cars, opulent vacations, and high-end real estate. These lifestyle choices have come under scrutiny in relation to their financial activities.

Couple’s Alleged Havehed History

- The couple reportedly amassed wealth through fraudulent claims.

- They lived in luxury, leading a lifestyle inconsistent with their declared incomes.

- Investigators are piecing together financial records to substantiate the fraud claims.

Impact on the Community

This case has sparked discussions about tax compliance and ethical financial practices within the community. The prosecution asserts that such fraudulent activities undermine the economy and trust in tax systems.

Next Steps in the Case

The couple’s legal battles are expected to unfold in the coming months, as authorities work to build a strong case. Each party will have the opportunity to present their argument as the investigation continues.