Trump Criticizes Powell as US Dollar Rebounds from Four-Year Lows

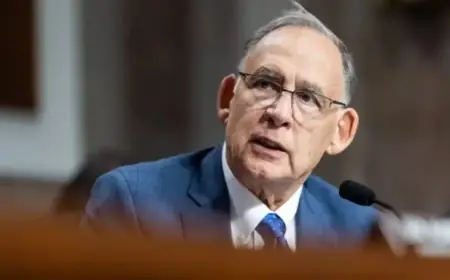

Financial markets experienced volatility recently, with significant movements influencing the U.S. Dollar’s performance. On January 30, former President Donald Trump voiced strong criticism against Federal Reserve Chairman Jerome Powell, suggesting the Fed should promptly lower interest rates.

Trump Criticizes Powell Amid Economic Concerns

In a post on Truth Social, Trump referred to Powell as “too late Powell,” claiming the Fed’s policies are detrimental to U.S. national security. This commentary follows the Federal Reserve’s decision to maintain the current federal funds rate during their meeting on January 29. Powell highlighted solid economic expansion in the U.S. over the previous year, noting stable unemployment rates and persistent inflation challenges.

Market Responses and Dollar Recovery

Wall Street saw a downturn, influenced by tech sector sell-offs. Microsoft Corporation’s stocks fell to a six-year low after reporting record expenditures in late 2025, raising concerns about the timeline for its artificial intelligence investments to yield returns.

The U.S. Dollar Index (DXY) rebounded from four-year lows, currently trading around 96.20, marking a notable recovery. Below is a summary of how the U.S. Dollar is performing against major currencies:

| Currency Pair | Percentage Change |

|---|---|

| USD/EUR | -0.09% |

| USD/GBP | -0.23% |

| USD/JPY | -0.33% |

| USD/CAD | 0.03% |

| USD/AUD | -0.22% |

| USD/NZD | -0.36% |

| USD/CHF | -0.09% |

Gold Market Overview

Gold prices have shown resilience as a safe-haven asset during economic uncertainty. The price was near $5,330, following a record high of $5,598 earlier in the session. Central banks remain significant purchasers of gold, with trends indicating a strong preference for the asset amidst fluctuating currencies.

In 2022, central banks accumulated 1,136 tonnes of gold valued at approximately $70 billion—the highest recorded annual purchase. As nations contend with economic instability, gold serves as a hedge against inflation and currency depreciation.

Future Economic Indicators

The upcoming economic reports include:

- Flash Germany Gross Domestic Product (GDP)

- Flash Eurozone GDP

- Flash German Consumer Price Index (CPI)

- U.S. Producer Price Index (PPI)

This window of economic data will provide crucial insights into the U.S. and European markets, shaping future financial strategies.