RBA Rate Hike: $1 Million Borrowers Face $1,900 Increase

The recent announcement from the Reserve Bank of Australia (RBA) indicates a possible rate hike that could significantly impact borrowers. If the RBA implements a 25 basis point increase, individuals with a $1 million mortgage may face an annual increase of almost $1,900 in their repayments. This situation arises as over half the economists surveyed by Finder predict prolonged higher rates.

Impact of RBA Rate Hike on Borrowers

According to the Finder cash rate survey, 51% of experts anticipate that the RBA will raise the cash rate during its February meeting. This rise would translate to an additional $158 monthly for those with a $1 million loan. Economists warn that this adjustment would exert additional pressure on household budgets.

- 25 basis point increase: $158 more on $1 million mortgage per month

- Annual increase: Nearly $1,900 for $1 million borrowers

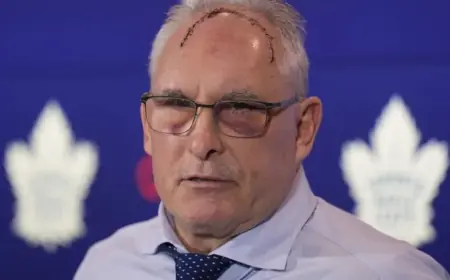

Graham Cooke, the head of consumer research at Finder, noted that many borrowers are unprepared for this change. He described the situation as a “cold shower” for homeowners who expected rates to fall after the previous easing phase. A typical rise of 25 basis points increases annual repayments by over $1,300 on an average mortgage.

Borrowing Power and Market Implications

Ari Levinson, a mortgage broker, warns that even minor rate hikes can rapidly decrease borrowing power. Banks often calculate serviceability based on current rates plus a buffer of around 3%. This calculation impacts both current borrowers and new buyers, potentially limiting the amount they can borrow by substantial amounts.

- Existing borrowers may see swift repayment increases.

- New buyers could face tens of thousands less in borrowing capacity.

Levinson emphasized the importance of strategically refinancing rather than reacting impulsively. He advised households to review their current rates and seek competitive offers from lenders to maximize savings.

Consequences for Housing Supply

Industry experts, such as Tim Reardon from the Housing Industry Association, indicate that higher interest rates could dampen new housing supply, particularly in the apartment sector. They argue that the current tax regime poses challenges for apartment development, discouraging investment and further constraining supply.

- Higher rates risk tightening housing supply.

- Tax policies currently applied are limiting new construction.

Economic Outlook

Looking ahead, economists believe that inflation control will remain a priority for the RBA. James Morley, a professor at the University of Sydney, noted that the central bank’s strategies would depend on future inflation trends. If inflation indicators rise again, the RBA could adopt a more aggressive approach.

Overall, as the potential for a February hike looms, borrowers are encouraged to assess their financial positions. Cooke highlights that the expectation of steady rate cuts has diminished, marking a new era of higher rates persisting for an extended period. Households should brace for economic uncertainty and avoid assumptions about imminent relief.