Silver Price Set for Change, Reveals Key Metric

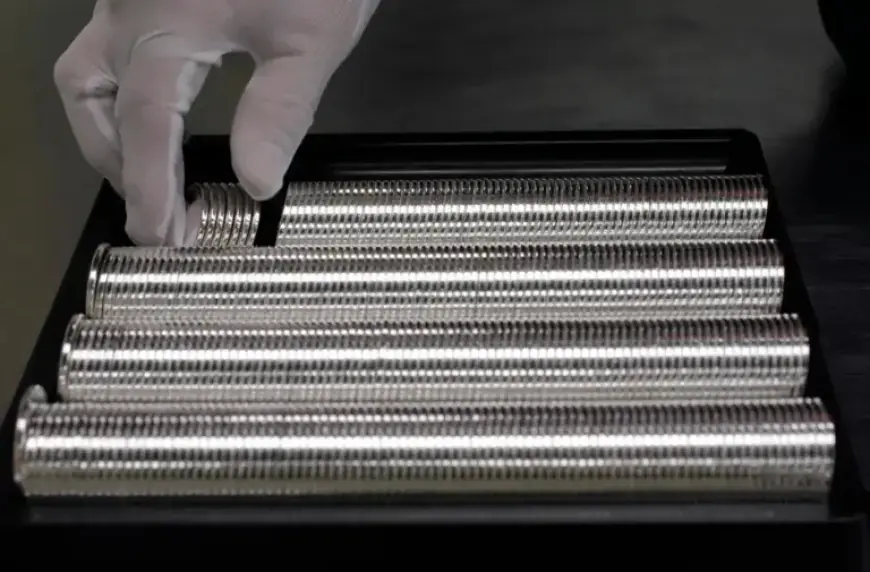

The recent surge in silver prices has garnered significant attention, with an impressive rise of 250% over the past year. This increase has brought silver’s value to an all-time high of $110 per ounce. The gold-to-silver ratio, which measures the price of an ounce of gold against silver, has fallen below 50 for the first time since March 2012, indicating that silver has nearly caught up with gold.

Current Market Dynamics and Investor Sentiment

Gold prices have also seen substantial growth, increasing by more than 80% over the last year to reach $5,100 per ounce. These noteworthy shifts in precious metals are attributed to a mix of geopolitical instability and economic factors. Investors are reacting to ongoing wars in Europe and the Middle East and escalating trade tensions between the United States and China. Additionally, the weakening confidence in the dollar due to rising U.S. debt and persistent inflation above 2% contributes to this trend.

The Global Economic Landscape

Political leaders have expressed concerns over the fragility of the global economic order established post-World War II. At the recent World Economic Forum in Davos, Canadian Prime Minister Mark Carney stated that the “rules-based international order” is under threat. Such a precarious situation prompts investors to seek refuge in precious metals, which are viewed as assets that retain value outside traditional currencies.

Historical Context of the Gold-to-Silver Ratio

The last time the gold-to-silver ratio fell below 50 was during a period of significant monetary policy shifts by the Federal Reserve. In 2012, the Fed’s Operation Twist aimed to reduce long-term interest rates by acquiring $667 billion in long-term bonds while selling short-term ones. This situation created uncertainty, leading investors to view gold and silver as safer options amidst worries over currency depreciation.

Future Projections for Silver and Gold

Currently, the market is observing an unusual trend in metals pricing. Historically, the gold-to-silver ratio has averaged around 70, dipping below 50 only in about 6% of trading days since 1985. This rarity prompts curiosity among investors about the potential for normalization.

- If gold remains stable at approximately $5,100 per ounce:

- Silver would need to drop to about $72 to restore the ratio to its long-term average of 70.

- If silver stays at $110:

- Gold would need to increase to about $7,700 per ounce to align with historical averages.

The ongoing geopolitical and economic conditions suggest that precious metals will continue to attract investment. As uncertainty prevails, understanding these market dynamics is crucial for investors at Filmogaz.com and beyond.