U.S. Stocks Rebound as Trump Cancels Greenland Tariff Plans

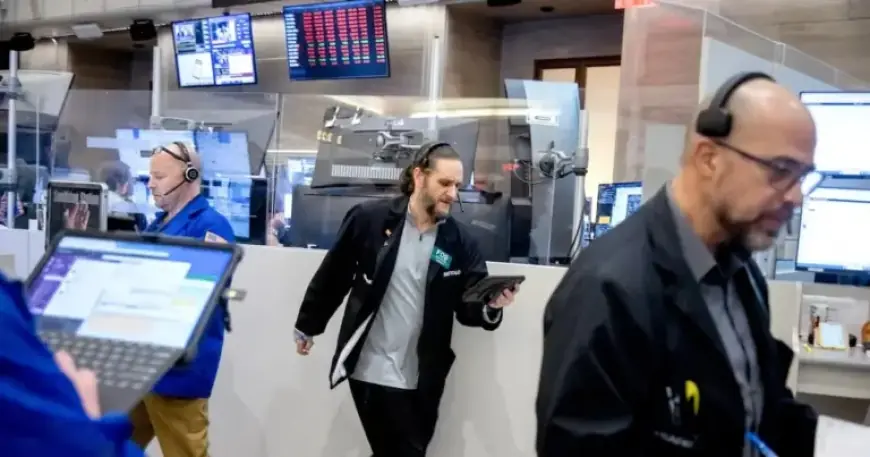

U.S. stocks experienced a significant rebound after President Donald Trump canceled plans to impose tariffs related to Greenland. This announcement brought immediate optimism to the market following a substantial decline the previous day.

Market Recovery Driven by Tariff Cancellation

On Wednesday, the S&P 500 rose by 1.2%, regaining momentum after a 2.1% drop. Trump’s comments suggested that a deal concerning Greenland “if consummated, will be a great one” for the U.S. and its North Atlantic allies. Investors responded positively to this de-escalation of tensions.

Key Market Movements

- Díow Jones Industrial Average: Up 588 points (1.2%) to 49,077.23

- S&P 500: Increased by 78.76 points to 6,875.62

- Nasdaq Composite: Gained 270.50 points to reach 23,224.82

This market recovery followed a series of statements from Trump, which included assurances to European leaders that he would not use force to pursue Greenland. The stock market’s positive trajectory was further supported by eased Treasury yields and a more stable U.S. dollar.

Sector Highlights

- Halliburton: Shares rose by 4.1% after exceeding analyst profit expectations.

- United Airlines: Increased by 2.2%, with strong revenue momentum continuing.

- Netflix: Dropped 2.2% despite a profit beat, as investor focus shifted to slowing subscriber growth.

- Kraft Heinz: Fell by 5.7% following Berkshire Hathaway’s hints of divesting its stake.

Interest Rates and Global Influence

In bond markets, the yield on the 10-year Treasury note decreased to 4.25%, down from 4.30% the previous day. This stabilizing trend reflects a reduction in investor anxiety following Trump’s tariff threats against multiple European nations.

International markets displayed mixed results. Japan’s Nikkei 225 experienced a minor decline of 0.4%, influenced by political developments regarding a snap election called by Prime Minister Sanae Takaichi.

Overall, the U.S. stock market’s recovery highlights how political decisions can swiftly alter investor sentiment. Market participants remain watchful of Trump’s evolving strategies and their potential impact on the economy.